What's Happening?

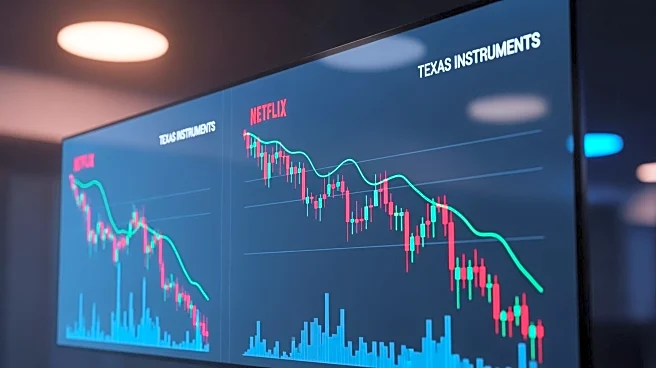

Major U.S. equities indexes experienced a decline following a series of weaker-than-expected earnings reports from prominent companies. Netflix shares dropped significantly after the streaming service

missed profit estimates, partly due to a tax dispute in Brazil. Texas Instruments also saw a decrease in share value after reporting disappointing earnings and providing a less optimistic outlook for the semiconductor sector. Conversely, Intuitive Surgical shares rose as the company exceeded earnings expectations, driven by increased use of its da Vinci surgical system. Other notable movements included DraftKings' acquisition of Railbird Technologies and Avery Dennison's partnership with Walmart to enhance food freshness tracking.

Why It's Important?

The stock movements reflect broader economic challenges facing U.S. companies, particularly in the technology and entertainment sectors. Netflix's earnings miss highlights the impact of international tax issues on global operations, while Texas Instruments' outlook suggests ongoing difficulties in the semiconductor industry. These developments may affect investor sentiment and influence market strategies for tech companies. On the positive side, Intuitive Surgical's success indicates strong demand for medical technology, which could drive innovation and growth in the healthcare sector. The mixed results underscore the volatility in the stock market and the need for companies to adapt to changing economic conditions.