What is the story about?

What's Happening?

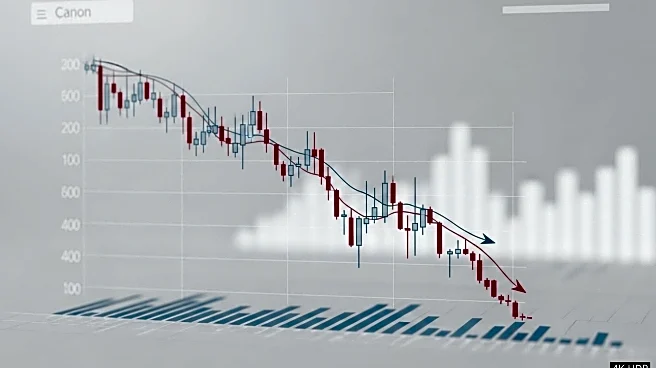

Figma's shares fell by 16% following the release of its first earnings report since its IPO in July. The design software company reported a 41% year-over-year increase in second-quarter revenue, reaching $249.6 million, slightly above analyst expectations. However, the company's guidance for the third quarter and full year did not meet investor expectations, contributing to the stock's decline. Additionally, Figma announced the early release of 25% of eligible securities owned by certain employees and service providers, which may have influenced investor sentiment.

Why It's Important?

Figma's performance and subsequent stock decline highlight the challenges faced by newly public companies in meeting market expectations. The company's high valuation and the impending release of locked-up shares may have contributed to investor caution. This situation underscores the importance of strategic communication and financial performance in maintaining investor confidence post-IPO.

What's Next?

Figma's future performance will depend on its ability to meet or exceed market expectations and effectively manage the release of locked-up shares. The company's strategic initiatives and market positioning will be crucial in regaining investor confidence and achieving sustainable growth.