What's Happening?

The U.S. inflation rate increased to 3% in September, up from 2.9% in August, according to the Consumer Price Index. The monthly increase was 0.3%, with significant contributions from rising gasoline and

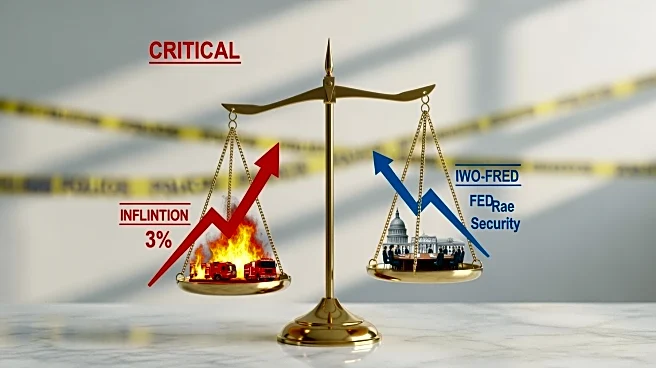

energy prices. Core inflation, excluding food and energy, rose 0.2%. The report comes amid a government shutdown, affecting data collection and economic analysis. The inflation data is critical for determining Social Security cost-of-living adjustments and Federal Reserve interest rate decisions.

Why It's Important?

The rise in inflation affects various economic stakeholders, including consumers, businesses, and policymakers. Higher inflation can erode purchasing power, impacting consumer spending and economic growth. The Federal Reserve faces challenges in balancing inflation control with economic stability, especially with limited data due to the government shutdown. Social Security recipients may see adjustments in their benefits based on the inflation data, affecting millions of Americans.

What's Next?

The Federal Reserve is expected to consider this inflation data in its upcoming interest rate decision, with potential rate cuts anticipated. The ongoing government shutdown may delay further economic data releases, complicating policy decisions. Stakeholders will be closely monitoring the Fed's actions and any changes in economic conditions. The impact on Social Security benefits will also be a key area of focus for policymakers and recipients.