What is the story about?

What's Happening?

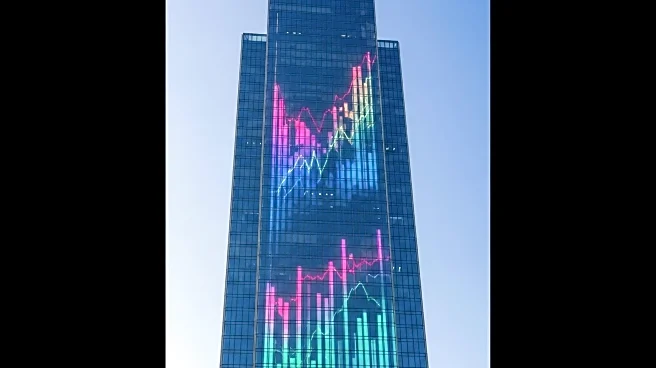

Wall Street experienced another day of record highs, driven by the continued rise in technology stocks and significant investments in artificial intelligence (AI). The Standard & Poor’s 500 index, Dow Jones industrial average, and Nasdaq composite all reached new peaks. This surge is largely attributed to the excitement surrounding AI and the substantial spending in the sector. Notably, OpenAI's announcement of partnerships with South Korean companies for the $500-billion Stargate project, aimed at building AI infrastructure, has fueled this momentum. Despite the ongoing U.S. government shutdown, which has delayed key economic reports, the stock market remains resilient. Investors are optimistic that the job market's slowdown will prompt the Federal Reserve to maintain or reduce interest rates, avoiding a recession.

Why It's Important?

The rise in technology stocks and AI investments highlights the growing influence of the tech sector on the U.S. economy. As AI becomes increasingly integrated into various industries, companies are investing heavily to capitalize on its potential. This trend is reshaping market dynamics, with tech stocks becoming dominant players. However, there are concerns about a potential bubble, as the rapid influx of capital into AI could lead to future market corrections. The situation also underscores the resilience of the stock market in the face of political uncertainties, such as the government shutdown, which historically has had limited impact on economic performance.

What's Next?

As the government shutdown continues, the delay in economic data releases could create uncertainty for investors. The Federal Reserve's decisions on interest rates will be closely watched, as they are crucial for maintaining economic stability. Additionally, the tech sector's performance will be monitored for signs of a bubble, with potential implications for investors and market stability. Companies involved in AI infrastructure projects, like OpenAI, will likely continue to drive market trends, influencing investment strategies across industries.