What's Happening?

T Rowe Associates Inc. MD has significantly increased its holdings in Taiwan Semiconductor Manufacturing Company (TSMC), acquiring an additional 1,984,835 shares during the last quarter. This acquisition

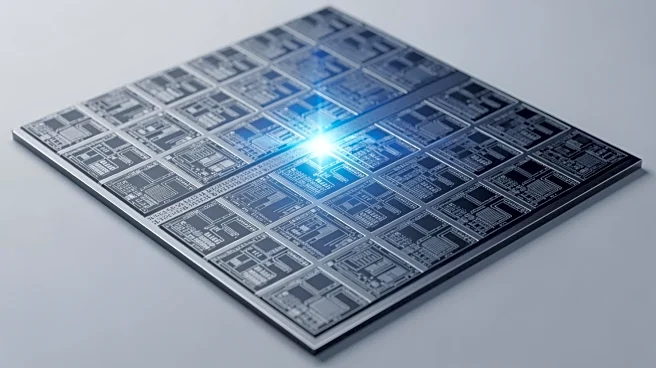

brings T Rowe's total ownership to 12,350,239 shares, valued at approximately $2,050,141,000. The move is part of a broader trend among institutional investors, including Goldman Sachs Group Inc. and Jennison Associates LLC, who have also increased their stakes in TSMC. The semiconductor company has been receiving positive ratings from analysts, with a 'Moderate Buy' consensus and an average target price of $371.67. TSMC's stock performance has been strong, with a recent trading price of $286.56 and a market capitalization of $1.49 trillion.

Why It's Important?

The increased investment by T Rowe Price and other institutional investors in TSMC highlights the growing confidence in the semiconductor industry, which is crucial for technological advancements and economic growth. TSMC's strong performance and positive analyst ratings suggest robust demand for its products, which could drive further innovation and expansion in the sector. This trend may benefit U.S. tech companies relying on semiconductor components, potentially leading to increased production capabilities and competitive advantages. However, it also underscores the dependency on foreign semiconductor manufacturers, which could pose risks related to supply chain disruptions and geopolitical tensions.

What's Next?

As TSMC continues to attract significant investments, the company is likely to focus on expanding its production capabilities and technological innovations to meet growing demand. Analysts forecast a positive earnings outlook, with expectations of continued revenue growth. The company's decision to increase its dividend payout further indicates confidence in its financial stability and future prospects. Stakeholders, including tech companies and investors, will closely monitor TSMC's strategic moves and market performance, as these could influence broader industry trends and investment strategies.

Beyond the Headlines

The increased stake in TSMC by major investors may have long-term implications for the semiconductor industry, including potential shifts in global production dynamics and increased competition among manufacturers. The reliance on TSMC's advanced technologies could drive further research and development efforts in the U.S., aiming to reduce dependency on foreign suppliers. Additionally, the focus on semiconductor innovation may lead to ethical considerations regarding data privacy and security, as these components are integral to modern digital infrastructure.