What's Happening?

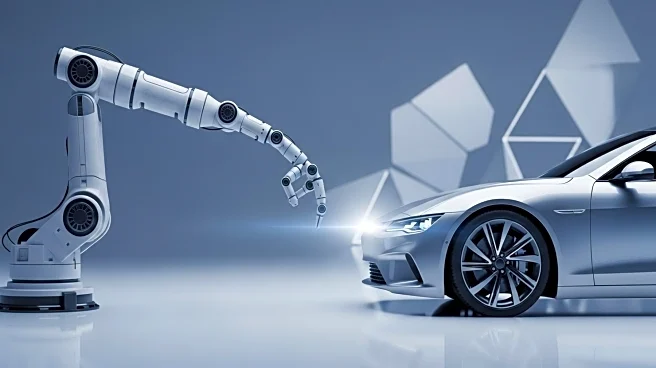

Tesla has received a price target increase from Goldman Sachs, reflecting optimism about its potential in robotics and autonomous technology. Analyst Mark Delaney raised the price target from $300 to $395, citing Tesla's opportunities in humanoid robotics and autonomy as key drivers for future growth. Despite the increase, Tesla's current trading price remains above the new target, leading to questions about the rationale behind the adjustment. Delaney emphasized that Tesla's success in these areas could lead to significant upside, but also warned of potential challenges from competition and execution risks. The company's narrative-driven stock performance continues to intrigue investors, as it navigates the complexities of expanding its technological capabilities.

Why It's Important?

The price target adjustment underscores the market's focus on Tesla's strategic initiatives in robotics and autonomous driving. As Tesla aims to solidify its position as a leader in these fields, the company's ability to execute on its ambitious projects will be critical. The increased price target reflects confidence in Tesla's innovation potential, but also highlights the uncertainties associated with pioneering new technologies. Investors and industry observers are closely monitoring Tesla's progress, as successful execution could redefine the landscape of autonomous vehicles and robotics, impacting market dynamics and competitive positioning.

What's Next?

Tesla is expected to continue advancing its robotics and autonomy projects, with a focus on refining its technologies and expanding its market presence. The company may face increased scrutiny from investors and analysts, who will be evaluating its ability to deliver on its promises. As Tesla works towards achieving its goals, it will likely encounter challenges related to competition and technological hurdles. The company's performance in these areas will be pivotal in determining its future stock valuation and market influence.