What's Happening?

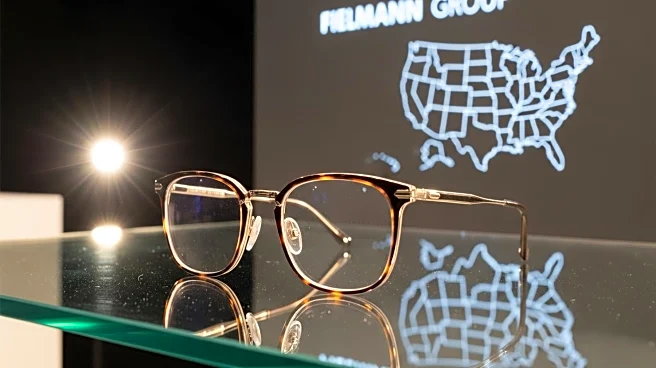

The Fielmann Group has reported significant growth in its Q2 2025 financial results, showcasing its strategic mastery in the optical retail sector. The company achieved a 12.3% year-over-year increase in consolidated sales, reaching €1.2 billion. This growth was driven by a combination of organic expansion and the full consolidation of its U.S. acquisition, Shopko Optical. Despite facing macroeconomic challenges such as inflation and geopolitical instability, Fielmann has managed to expand its adjusted EBITDA margin by 2.6 percentage points to 23.7%. The U.S. market has become a key area of growth, with a 143% year-over-year revenue surge attributed to the Shopko Optical acquisition. Fielmann's strategic focus includes scaling its U.S. business to $1 billion in sales by 2030, while also expanding its presence in mature European markets and emerging regions.

Why It's Important?

Fielmann's robust performance in Q2 2025 highlights its ability to navigate economic challenges and capitalize on strategic opportunities. The company's expansion into the U.S. market is particularly significant, as it positions Fielmann as a global leader in vision and hearing care. This growth strategy not only enhances its market presence but also diversifies its revenue streams, reducing reliance on European markets. The company's digital transformation initiatives further strengthen customer loyalty and mitigate traditional retail volatility. For investors, Fielmann's disciplined execution and strategic acquisitions present a compelling case for sustained profitability. As the company transitions from a regional optical retailer to a global healthcare provider, its Vision 2035 roadmap offers a clear path to achieving €4 billion in global sales by 2030.

What's Next?

Fielmann is set to continue its expansion strategy, focusing on achieving its Vision 2035 goals. The company plans to double its sales in the U.S. and European audiology markets by 2030. Additionally, Fielmann aims to build Europe's leading tele-ophthalmological platform, expanding into adjacent healthcare services. This strategic direction will likely involve further acquisitions and investments in digital infrastructure to enhance customer value and operational efficiency. As Fielmann pursues these objectives, stakeholders can expect continued growth and innovation in the optical retail sector.

Beyond the Headlines

Fielmann's strategic growth not only impacts its financial performance but also reflects broader trends in the retail and healthcare industries. The company's focus on digital transformation and high-margin services like audiology and premium eyewear aligns with consumer demand for personalized and convenient healthcare solutions. This shift towards a digital-first approach may influence other retailers to adopt similar strategies, potentially reshaping the competitive landscape. Furthermore, Fielmann's expansion into the U.S. market underscores the importance of geographic diversification in mitigating economic risks and enhancing growth potential.