What's Happening?

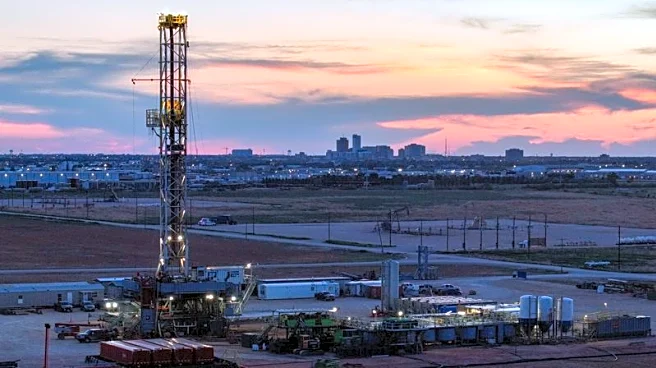

Mach Natural Resources LP has reported steady third-quarter results for 2025, highlighting production growth and improved capital efficiency. The company averaged 94,000 boed and generated $273 million in revenue. Mach completed acquisitions in the Permian

and San Juan basins, enhancing its operational footprint. The company achieved strong well performance, including significant output from Mancos Shale and Deep Anadarko wells. Mach has reduced drilling and completion capital by 18% and declared a quarterly cash distribution of $0.27 per common unit.

Why It's Important?

Mach Natural Resources' expansion in the Permian and San Juan basins represents a strategic move to increase production capacity and operational efficiency. This development could strengthen the company's competitive position in the U.S. energy market and attract investor interest. The focus on capital efficiency and well performance may lead to increased profitability and shareholder returns. The acquisitions and production growth could also impact local economies and employment in the regions.

What's Next?

Mach Natural Resources plans to integrate its new assets and deploy capital efficiently across its operations. The company may explore further acquisitions or partnerships to enhance its market presence. Stakeholders will be monitoring Mach's ability to maintain production growth and financial stability amidst fluctuating oil prices. Regulatory changes and environmental considerations may also influence the company's strategic decisions.

Beyond the Headlines

The expansion of Mach Natural Resources could have implications for energy policy and environmental regulations, as increased production may attract scrutiny from policymakers. The company's approach to sustainability and community engagement will be important in addressing these challenges. Additionally, the acquisitions may influence global oil markets, as increased U.S. production could affect international supply and pricing.