What's Happening?

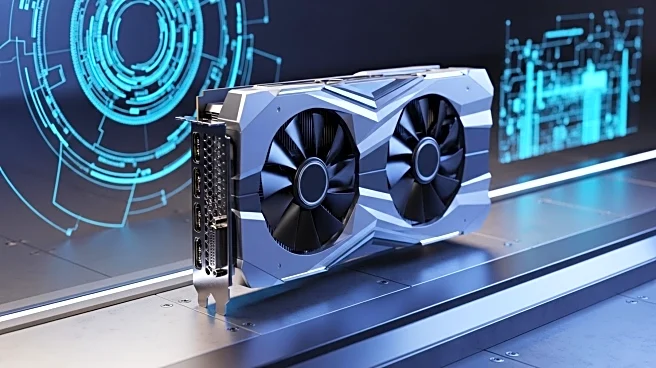

Nvidia's stock experienced a notable increase, rising by 4% as of Wednesday afternoon. This surge is attributed to Oracle's recent earnings report, which revealed a substantial revenue backlog. Oracle disclosed $455 billion in total remaining performance obligations, a figure significantly larger than anticipated by Wall Street analysts. The cloud infrastructure provider plans to invest $35 billion in capital expenditures during its fiscal 2026, primarily targeting AI computing infrastructure, including Nvidia's chips. This announcement has bolstered investor confidence in Nvidia, reflecting strong demand for its AI technology.

Why It's Important?

Oracle's commitment to AI infrastructure spending underscores the ongoing demand for Nvidia's chips, which are integral to AI data centers. This development is crucial for Nvidia as it alleviates concerns about a potential slowdown in AI investment, which could impact its financial performance. The substantial revenue backlog reported by Oracle suggests robust future growth prospects for Nvidia, reinforcing its position as a leading player in the AI infrastructure market. Investors and industry stakeholders are likely to view this as a positive indicator of sustained demand for AI technologies.

What's Next?

With Oracle's significant investment in AI infrastructure, Nvidia is poised to benefit from increased demand for its chips. The company's strong position in the AI market may lead to further stock appreciation as investors anticipate continued growth. However, the risk of a slowdown in AI spending remains a concern, and stakeholders will be closely monitoring market trends and investment patterns. Nvidia's ability to capitalize on this opportunity will be crucial in maintaining its competitive edge in the rapidly evolving AI sector.