What's Happening?

Several manufacturing stocks have been identified as promising investments, according to MarketBeat's stock screener tool. These stocks include Taiwan Semiconductor Manufacturing, Applied Materials, Johnson

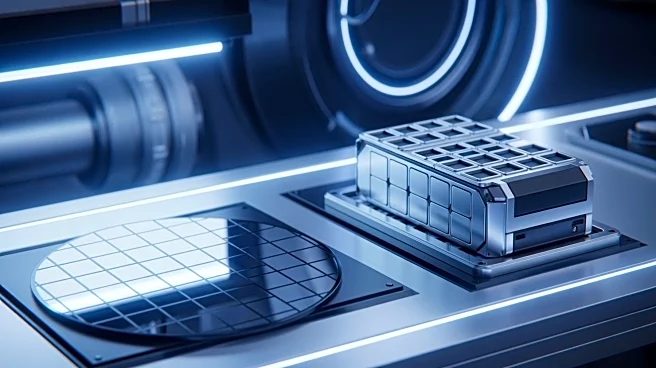

Controls International, Stellantis, Phillips 66, Jabil, and Flex. These companies are involved in producing physical goods such as machinery, vehicles, electronics, and consumer durables. The stocks are considered cyclical and capital-intensive, with revenues and profits sensitive to economic growth, commodity costs, and global trade conditions. Taiwan Semiconductor Manufacturing is a major player in the semiconductor industry, providing a range of wafer fabrication processes. Applied Materials supplies manufacturing equipment and services to the semiconductor and display industries. Johnson Controls International focuses on building products and systems, while Stellantis designs and manufactures automobiles. Phillips 66 operates in the energy sector, providing logistics and manufacturing services. Jabil offers electronics design and production services, and Flex provides technology and supply chain solutions.

Why It's Important?

The identification of these manufacturing stocks as promising investments highlights the sectors' potential for growth and profitability. The semiconductor industry, represented by Taiwan Semiconductor Manufacturing and Applied Materials, is crucial for technological advancements and innovation. As demand for electronics and digital solutions continues to rise, these companies are well-positioned to benefit. The energy sector, with Phillips 66, plays a vital role in global logistics and manufacturing, impacting fuel prices and energy availability. Companies like Stellantis and Johnson Controls International contribute to the automotive and building industries, which are significant drivers of economic activity. Investors may find opportunities in these stocks due to their cyclical nature, which aligns with economic growth and global trade conditions.

What's Next?

Investors and analysts will likely monitor these stocks closely for changes in market conditions and economic indicators. The semiconductor industry may see increased demand due to technological advancements, potentially boosting Taiwan Semiconductor Manufacturing and Applied Materials. The energy sector's performance will depend on global oil prices and environmental policies, affecting Phillips 66. Automotive and building sectors, represented by Stellantis and Johnson Controls International, may experience shifts based on consumer demand and infrastructure developments. Flex and Jabil's focus on technology and supply chain solutions may benefit from increased digitalization and globalization trends.

Beyond the Headlines

The focus on manufacturing stocks underscores the importance of these sectors in driving economic growth and innovation. The semiconductor industry's role in technology development is critical, influencing everything from consumer electronics to advanced computing systems. Energy companies like Phillips 66 are pivotal in shaping environmental policies and sustainability efforts. The automotive and building industries contribute to infrastructure development and urbanization, impacting societal trends and economic stability. As these sectors evolve, they may face challenges related to regulatory changes, technological disruptions, and shifts in consumer preferences.