What is the story about?

What's Happening?

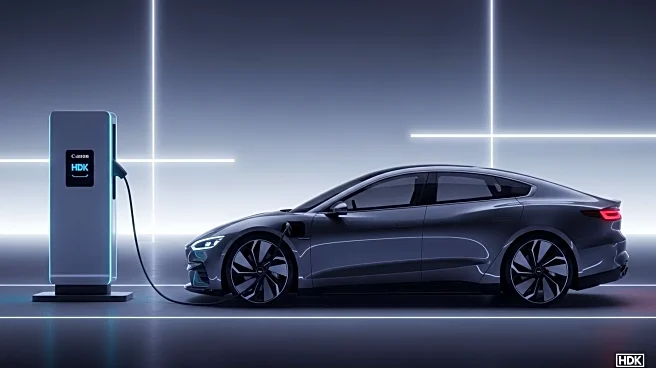

Tesla is poised for a strong fourth quarter in 2025, driven by the anticipated launch of more affordable models. The company delivered over 497,000 vehicles in Q3, a record high, and is now focusing on pricing strategies to maintain sales momentum. The end of the federal EV tax credit in the U.S. has shifted sales dynamics, but Tesla's aggressive pricing for models like the Model Y and Model 3 could expand its market reach. In China, Tesla faces high competition, yet demand remains strong, while in Europe, sales are mixed with some regions showing growth.

Why It's Important?

Tesla's strategy to introduce lower-priced models is crucial in sustaining its competitive edge in the EV market, especially after the expiration of federal incentives. By offering vehicles at more accessible price points, Tesla can attract a broader customer base, potentially offsetting the impact of lost tax credits. This approach not only supports Tesla's sales targets but also influences the broader EV market by setting pricing benchmarks that other automakers may follow. The company's focus on affordability could drive significant market shifts and consumer behavior changes.

What's Next?

Tesla plans to release a more affordable Model Y, with prices expected to start below $35,000 in the U.S. and $30,000 in China. This move is likely to stimulate demand and could lead to increased sales in the fourth quarter. Additionally, Tesla's advancements in Full Self Driving (FSD) technology and potential new model releases could further enhance its market position. The company's ability to ramp up production and meet demand will be critical in achieving its sales goals and maintaining investor confidence.