What's Happening?

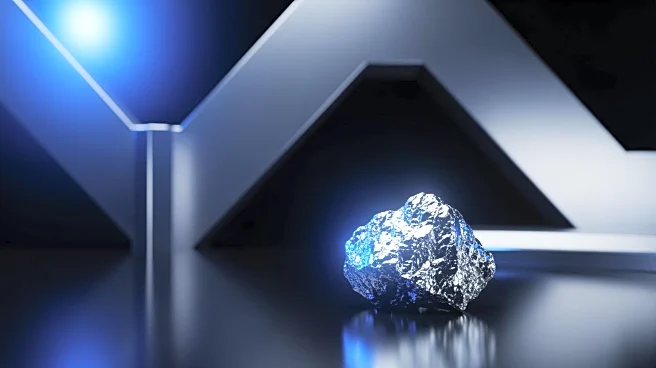

The US government is increasing its equity stakes in critical minerals companies as part of a strategy to counter China's dominance in the supply of essential raw materials. Jarrod Agen, executive director

of the National Energy Dominance Council, announced this move, highlighting its necessity in the face of China's control over materials crucial for various technologies, including semiconductors and defense systems. Over the past year, the Trump administration has invested over $1 billion in these companies, including a $400 million stake in MP Materials Corp. and a $670 million stake in Vulcan Elements Inc. This strategy aims to reduce US reliance on China, which has previously restricted exports of rare-earth elements in response to US trade measures.

Why It's Important?

This development is significant as it represents a strategic shift in US policy to secure critical supply chains and reduce dependency on China for essential minerals. These materials are vital for the production of high-tech devices and defense systems, making them crucial for national security and economic stability. By investing in domestic and allied companies, the US aims to bolster its industrial base and ensure a steady supply of these resources. This move could also influence global trade dynamics, as it challenges China's current dominance in the market for critical minerals.

What's Next?

The US government is likely to continue its investment strategy, seeking further opportunities to acquire stakes in companies that produce critical minerals. This approach may lead to increased collaboration with allied nations to develop alternative supply chains. Additionally, the US may implement policies to encourage domestic production and innovation in the critical minerals sector. The ongoing trade tensions with China could further escalate if the US continues to challenge China's market position.