What's Happening?

Jim Cramer's Charitable Trust has made strategic adjustments to its investment portfolio by selling shares of Eli Lilly and purchasing shares of Nike and Procter & Gamble. The Trust sold 10 shares of Eli Lilly at approximately $1,034 each, reducing its holding

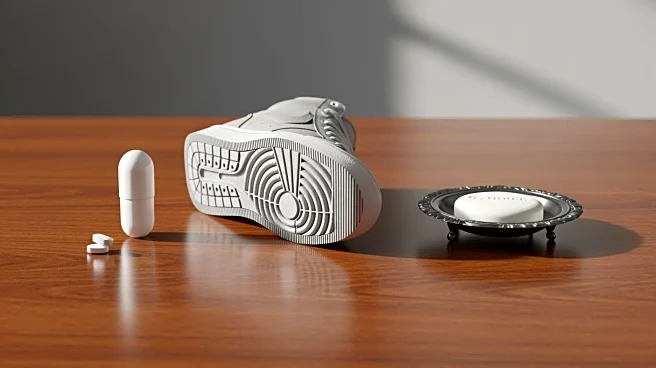

to 90 shares and decreasing its portfolio weighting from 2.8% to 2.5%. This decision comes after Eli Lilly's shares reached an all-time high, with a significant rally of 55% since August. The Trust also increased its position in Nike by buying 100 shares at around $62, raising its portfolio weighting from 2.2% to 2.4%. Additionally, a new position was initiated in Procter & Gamble with the purchase of 250 shares at roughly $146, giving it a 1% weighting in the portfolio. These moves reflect a strategic shift in focus towards companies with strong growth potential and economic resilience.

Why It's Important?

The portfolio adjustments by Jim Cramer's Charitable Trust highlight a strategic approach to managing investments in a volatile market. By trimming Eli Lilly shares, the Trust is capitalizing on significant gains while managing risk associated with parabolic stock movements. The decision to increase holdings in Nike and initiate a position in Procter & Gamble indicates confidence in these companies' ability to perform well despite broader market challenges. Nike's turnaround strategy under CEO Elliott Hill and Procter & Gamble's consistent growth track record make them attractive investments. These moves suggest a potential shift in investor sentiment towards stable, economically resilient companies as the market transitions away from high-growth sectors like AI.

What's Next?

The Trust's actions may influence other investors to reconsider their portfolios, potentially leading to increased interest in consumer staples and companies with strong fundamentals. As the market evolves, there could be a rotation back into these sectors, driven by a renewed appreciation for steady, predictable growth. Procter & Gamble's plans for share repurchases and dividend increases further enhance its appeal as a reliable investment. Investors will likely monitor these developments closely, assessing the impact on market dynamics and adjusting their strategies accordingly.