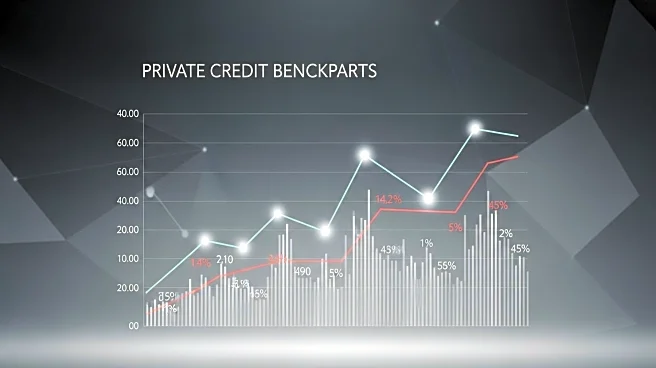

What's Happening?

Kroll, a leading provider of financial and risk advisory solutions, and StepStone Group, a global private markets investment firm, have announced the launch of the Kroll StepStone Private Credit Benchmarks. This new industry standard aims to provide more robust and rigorous valuation and intelligence into private credit investment characteristics. The benchmarks are developed using loan-level data from over 15,000 deals, offering timely, reliable, and actionable insights essential for the growth of private investment markets. The benchmarks will be updated weekly with new primary market data, providing aggregated, anonymized insights across various regions, sectors, and loan security types.

Why It's Important?

The introduction of the Kroll StepStone Private Credit Benchmarks is significant as it addresses the growing investor interest and confidence in private markets. With the 'retailification' of private capital, investors are expected to allocate more resources to private markets in the coming years. The benchmarks offer a rigorous solution for near real-time market monitoring, facilitating better capital allocation decision-making and portfolio monitoring. This development is crucial as retail investors, who control over 50% of global wealth, are beginning to shift from public to private market investment strategies, marking an inflection point in the industry.

What's Next?

Kroll and StepStone Group will host a joint webinar on September 16 to introduce the Private Credit Benchmarks. This event will provide further insights into the benchmarks and their application in private credit investment strategies. As the industry continues to evolve, the collaboration between Kroll and StepStone is expected to drive market transition and enhance transparency and intelligence for private credit market participants.

Beyond the Headlines

The launch of these benchmarks could lead to long-term shifts in how private credit investments are evaluated and managed. By providing granular benchmarking, the initiative may improve transparency and decision-making for investors, potentially influencing the broader private markets ecosystem. This could also impact the strategies of institutional investors and wealth managers as they adapt to the evolving landscape of private market investments.