What's Happening?

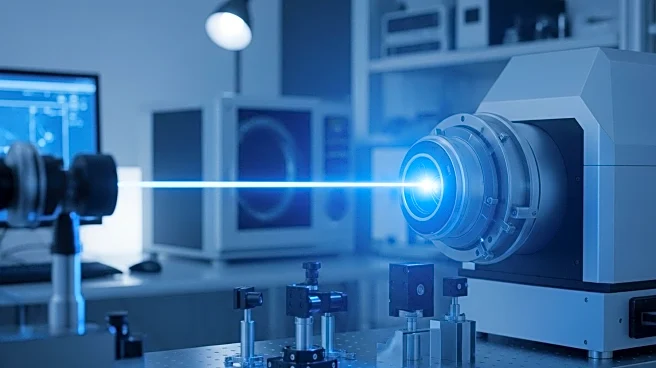

Laser Photonics Corporation, a leader in industrial laser systems, has successfully closed a $4 million private placement. The financing involved the issuance of 1,098,902 shares of common stock at $3.64 per share, along with Series A and B warrants priced at $3.40 per share. This capital infusion is intended to strengthen the company's balance sheet and support the integration and growth of its recent acquisitions, CMS and Beamer. These acquisitions are expected to open new high-value markets for Laser Photonics. The company aims to use the funds to drive sales, expand its strategic opportunities, and enhance shareholder value. H.C. Wainwright & Co. acted as the exclusive placement agent for this offering.

Why It's Important?

The successful capital raise is significant for Laser Photonics as it provides the financial resources needed to expand its market presence and accelerate growth. The company's focus on industrial laser technologies positions it well in sectors such as aviation, automotive, and defense, which are increasingly adopting laser solutions for efficiency and environmental benefits. The funding also reflects investor confidence in Laser Photonics' long-term strategy and market demand for its innovative solutions. This development could lead to increased competitiveness and market share in the industrial laser sector, benefiting stakeholders and potentially driving further technological advancements.

What's Next?

With the new funding, Laser Photonics plans to continue executing its growth strategy, which includes expanding its product offerings and entering new markets. The company will also focus on integrating its recent acquisitions to maximize their impact. Additionally, Laser Photonics is expected to file registration statements with the SEC to cover the resale of the securities, ensuring compliance with regulatory requirements. The market will likely monitor the company's progress in leveraging this capital to achieve its strategic goals and enhance shareholder value.