What's Happening?

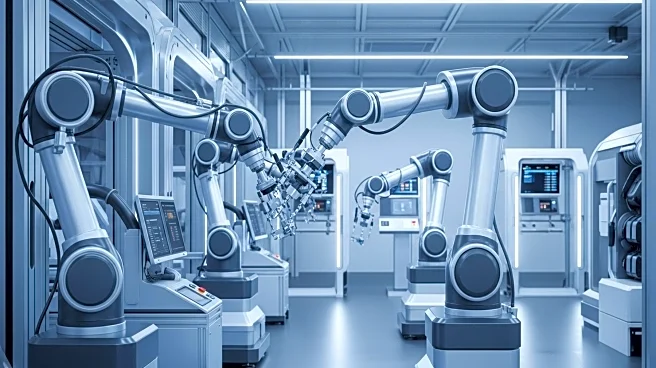

Resonetics, a leader in advanced engineering and manufacturing solutions for the medical device industry, has announced the acquisition of Eden Holdings. This acquisition includes Eden Manufacturing and Eden Tool, both specializing in precision injection molding and micro machining solutions for critical medical devices. The move enhances Resonetics' capabilities in micro-molding, insert-molding, and advanced machining, complementing its existing metal processing expertise. This expansion is aimed at serving high-growth markets such as robotic surgery, minimally invasive surgery, electrophysiology, and rapid diagnostics. Eden Holdings, founded in 2000, is known for its precision tooling and machining, which has evolved into high precision micro and insert molding for the MedTech industry.

Why It's Important?

The acquisition of Eden Holdings by Resonetics is significant for the MedTech industry as it strengthens Resonetics' position as a comprehensive provider of precision manufacturing solutions. By integrating Eden's expertise in injection molding and precision tooling, Resonetics can offer more integrated solutions across various materials and technologies. This expansion is likely to benefit the medical device industry by providing enhanced capabilities for developing complex medical devices. The acquisition also positions Resonetics to better serve its customers with a broader range of services, potentially leading to innovations in medical technology and improved patient outcomes.

What's Next?

With the acquisition complete, Resonetics is expected to integrate Eden's capabilities into its existing operations, leveraging the combined expertise to enhance its service offerings. The company may focus on expanding its market reach and exploring new opportunities in the MedTech sector. Stakeholders, including customers and partners, are likely to monitor how the integration unfolds and the impact it has on product development and service delivery. Resonetics' strategic growth through acquisitions could set a precedent for further consolidation in the MedTech industry.