What's Happening?

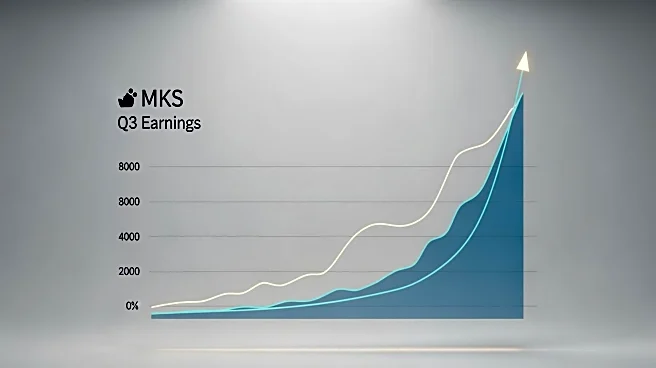

MKS Instruments has reported its third-quarter earnings for 2025, showcasing a significant increase in revenue and earnings per share (EPS) compared to the previous year. The company achieved a revenue of

$988 million, marking a 10.3% rise from the same period last year, and an EPS of $1.93, up from $1.72. This performance exceeded the Zacks Consensus Estimate, with a revenue surprise of +2.7% and an EPS surprise of +7.22%. MKS's semiconductor segment reported net revenues of $415 million, a 9.8% increase year-over-year, while the electronics and packaging segment saw a 25.1% rise to $289 million. The company is positioned to capitalize on the growing demand for technologies like Artificial Intelligence, Machine Learning, and the Internet of Things.

Why It's Important?

The strong earnings report from MKS Instruments highlights the company's robust position in the semiconductor industry, which is experiencing rapid growth. With global semiconductor manufacturing projected to nearly double by 2028, MKS's performance indicates its potential to benefit significantly from this expansion. The company's ability to exceed market expectations suggests a positive outlook for investors and stakeholders, as it continues to innovate and expand its customer base. This growth is crucial for maintaining competitiveness in a sector that is pivotal to technological advancements and economic development.

What's Next?

MKS Instruments is expected to continue leveraging its strengths in semiconductor products to capitalize on the industry's growth. The company's strategic positioning and expanding customer base may lead to further revenue increases and market share gains. Investors and analysts will likely monitor MKS's performance closely, anticipating continued positive results and potential strategic moves to enhance its market position.