What is the story about?

What's Happening?

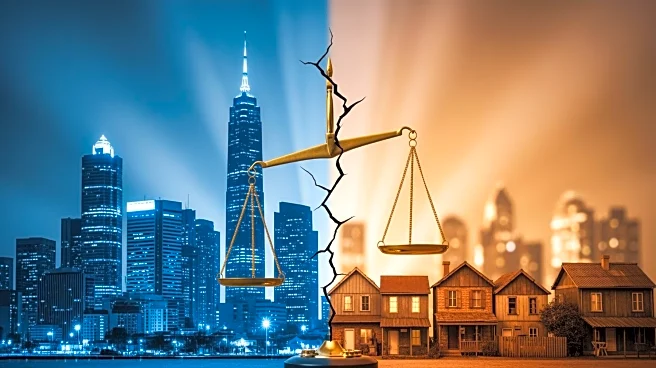

AstraZeneca has announced a strategic shift in its stock market presence by delisting its American Depositary Receipts (ADRs) from Nasdaq and opting for a direct listing of ordinary shares on the New York Stock Exchange. This move is part of a broader trend among major companies relocating their primary listings from the U.K. to the U.S., driven by the desire for better access to capital and a more diverse investor base. The decision follows AstraZeneca CEO Pascal Soriot's previous discussions about moving the company's stock market listing to the U.S., amid frustrations with the U.K.'s drug-pricing regime. The move is expected to attract new U.S. investors and potentially lead to AstraZeneca's inclusion in the S&P 500, although this is not guaranteed.

Why It's Important?

The relocation of AstraZeneca's stock listing to New York is significant as it reflects a growing trend of major companies moving away from the London Stock Exchange. This shift could have broader implications for the U.K. market, potentially reducing its attractiveness to international investors. The move also highlights ongoing challenges within the U.K.'s regulatory environment, particularly concerning drug pricing, which may deter pharmaceutical investments. For AstraZeneca, the decision could enhance its access to larger pools of capital and a broader mix of global investors, potentially boosting its market valuation and financial flexibility.

What's Next?

AstraZeneca's decision may prompt other companies to consider similar moves, especially those frustrated with the U.K.'s regulatory environment. The British government may need to address these concerns to prevent further defections, possibly by revising tax policies like the Stamp Duty Reserve Tax. Meanwhile, AstraZeneca will focus on integrating its operations with the New York Stock Exchange and leveraging the benefits of its new listing to enhance its market position.

Beyond the Headlines

The shift in AstraZeneca's listing could signal a long-term trend of U.K.-based companies seeking more favorable conditions in the U.S. market. This may lead to a reevaluation of the U.K.'s financial and regulatory policies to retain its competitive edge. Additionally, the move underscores the importance of global capital markets in shaping corporate strategies and the need for countries to adapt to changing economic landscapes.