What's Happening?

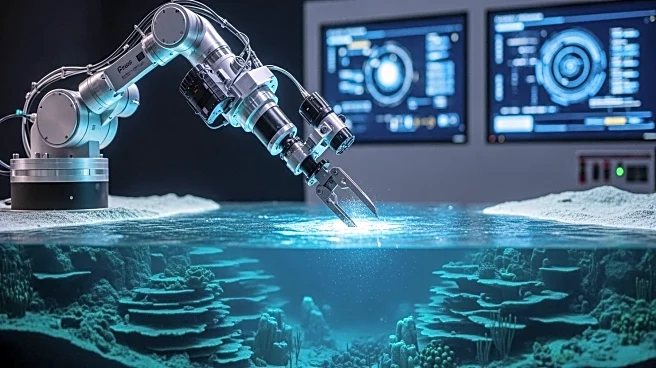

Nauticus Robotics Inc., a subsea robotics developer based in Webster, Texas, has announced the acquisition of a $250 million equity line of credit. This financial boost is intended to support the company's

expansion into deep-sea rare earth and mineral exploration. The credit line will enable Nauticus to pursue strategic acquisitions that enhance its technological capabilities, particularly in industries critical to the global energy transition. The company plans to leverage its autonomous systems, such as the Aquanaut, to explore and manage underwater resources, contributing to the supply chain of clean energy, electronics, and defense industries.

Why It's Important?

The move by Nauticus Robotics to secure substantial funding for deep-sea exploration is pivotal in the context of global resource management and technological advancement. Access to rare earth minerals is crucial for the development of clean energy technologies, electronics, and defense systems. By expanding its capabilities in this area, Nauticus is positioning itself as a key player in the sustainable extraction of these resources. This initiative aligns with broader efforts to reduce reliance on international mineral producers, thereby enhancing national security and economic stability. The company's focus on environmental stewardship also highlights the importance of sustainable practices in resource development.

What's Next?

Nauticus Robotics plans to identify and acquire businesses and technologies that complement its existing portfolio, with a focus on sustainable innovation. The company aims to support the responsible exploration of rare earth elements and other critical minerals found in ultra-deep-water environments. As part of its strategic growth, Nauticus will provide updates on prospective acquisition targets and partnerships. This aligns with U.S. priorities on securing strategic minerals, potentially reducing reliance on international producers. Additionally, Nauticus has agreed to convert $3.7 million of debt into common equity, which will help de-leverage its balance sheet and address Nasdaq de-listing concerns.