What's Happening?

Chancellor Rachel Reeves is reportedly set to introduce a new pay-per-mile tax for electric vehicles (EVs) in the upcoming Autumn Budget. This proposal aims to impose a 3 pence per mile levy on EVs, in addition

to existing road taxes, to address declining revenue from petrol and diesel vehicles as more motorists switch to greener alternatives. The measure is intended to ensure fairness between EV drivers and those using traditional fuel vehicles. The Treasury is expected to outline these proposals on November 26, with the potential to add approximately £250 annually to motoring costs for EV drivers. Additionally, the budget may include changes to fuel duty, Vehicle Excise Duty (VED), and classic car tax exemptions, as well as adjustments to salary sacrifice schemes and VAT rates for electric car charging.

Why It's Important?

The proposed pay-per-mile tax for electric vehicles represents a significant shift in how the government plans to generate revenue from road users. As fuel-duty receipts decline due to the increasing adoption of EVs, this measure seeks to balance fiscal needs with environmental goals. The tax could impact EV adoption rates, potentially stifling growth if implemented prematurely. It also raises concerns about fairness, as EV drivers currently benefit from lower operating costs compared to petrol and diesel vehicle owners. The broader implications include potential changes to classic car tax exemptions and salary sacrifice schemes, which could affect various stakeholders, including car owners, businesses, and the automotive industry.

What's Next?

The Autumn Budget, scheduled for November 26, will reveal the final details of these proposals. Stakeholders, including political leaders, automotive industry representatives, and environmental groups, are likely to react to the proposed changes. The government will need to address concerns about the timing and fairness of the new tax, ensuring it aligns with net-zero goals without penalizing greener drivers. Discussions may also focus on the impact of potential changes to fuel duty, VED rates, and classic car tax exemptions, as well as the implications for salary sacrifice schemes and VAT rates for public EV charging.

Beyond the Headlines

The introduction of a pay-per-mile tax for electric vehicles could have long-term implications for the automotive industry and environmental policy. It may influence consumer behavior, potentially slowing the transition to electric vehicles if perceived as punitive. The measure also highlights the government's challenge in balancing fiscal needs with environmental commitments, as it seeks to modernize revenue streams without discouraging sustainable practices. The broader debate may explore ethical considerations around taxation fairness and the role of government in promoting green technology.

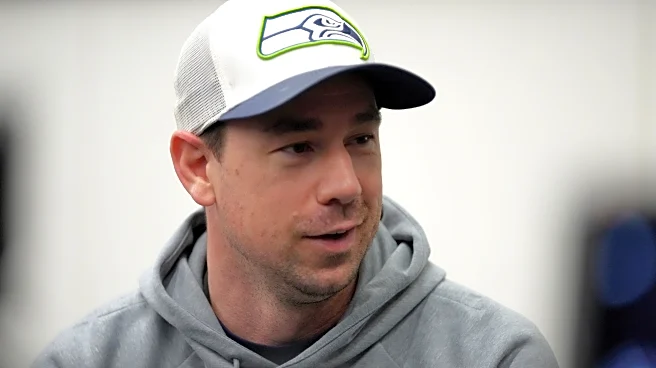

![Daily Slop: 12 Feb 26 – New Commanders OC David Blough: “How do we get Terry [McLaurin] 10 targets a game?“](https://glance-mob.glance-cdn.com/public/cardpress/binge-magazine-card-generation/spaces/US/en/sb-nation/images/ppid_2cf3d240-image-177091266842313096.webp)