What's Happening?

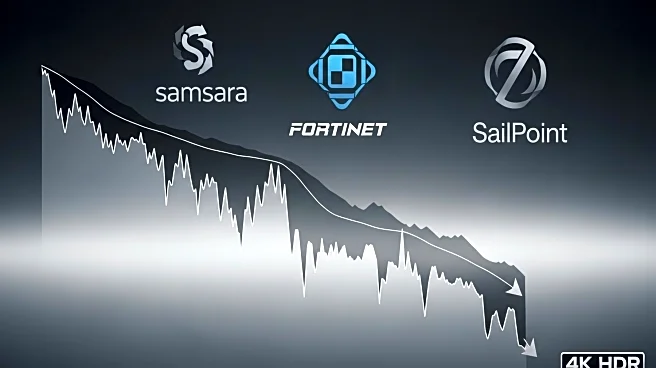

The S&P 500 experienced a decline on Friday, closing down by 0.32% at 6,481.50, despite reaching a 52-week high earlier in the day. This downturn was influenced by a cooler-than-expected jobs report, which saw the unemployment rate rise to 3.8% from 3.5% in July. Analysts have highlighted Samsara, Fortinet, and SailPoint as top picks amidst the market fluctuations. SailPoint, based in Austin, Texas, is anticipated to report earnings on September 9, with expected revenue of $243.226 million and earnings of 4 cents per share. Meanwhile, Broadcom and DocuSign's earnings reports also impacted market movements, with Broadcom missing analyst estimates and DocuSign exceeding expectations.

Why It's Important?

The disappointing jobs report has raised concerns about the Federal Reserve's potential actions regarding interest rates. The increase in unemployment could prompt the Fed to consider rate cuts, which would have significant implications for the economy. Analysts have identified stocks like Microsoft and Apple as potential beneficiaries of such cuts. The S&P 500's year-to-date change remains positive at 10.2%, indicating continued economic growth despite recent setbacks. The focus on tech stocks, as evidenced by the Nasdaq's 2% gain for the week, underscores the sector's resilience and potential for future growth.

What's Next?

Market participants are closely watching the Federal Reserve's next moves, as speculation about interest rate adjustments continues. The upcoming earnings report from SailPoint on September 9 will be a key event, potentially influencing investor sentiment and stock performance. Analysts and investors will also monitor broader economic indicators to assess the trajectory of the U.S. economy and the potential impact on various sectors.