What is the story about?

What's Happening?

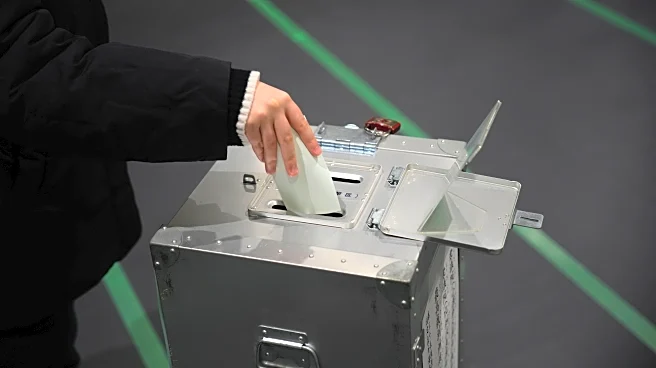

The proposed merger between Vancouver-based Teck Resources and London-based Anglo American has sparked discussions about the future of Canada's mining industry. The deal, which involves significant commitments to maintain Canadian operations, aims to create a major player in the critical minerals sector. However, concerns about foreign ownership and the potential loss of Canadian identity in the mining sector have been raised. The merger is subject to approval under the Investment Canada Act, with promises to keep the headquarters in Vancouver and maintain employment levels.

Why It's Important?

This merger could reshape the Canadian mining landscape, as Teck is one of the last major Canadian-owned mining companies. The deal highlights the global demand for critical minerals like copper, essential for renewable energy technologies. The merger's approval could set a precedent for future foreign investments in Canada's resource sector, impacting national economic sovereignty and job security. The Canadian government's decision will reflect its stance on foreign ownership and its commitment to preserving domestic industry.

What's Next?

The merger will undergo scrutiny under the Investment Canada Act, with the government assessing whether it provides a net benefit to Canada. If approved, the merger could lead to further consolidation in the mining industry, potentially attracting other global players. The outcome will influence Canada's ability to maintain control over its natural resources and the strategic direction of its mining sector.

Beyond the Headlines

The ethical considerations of foreign ownership in Canada's resource sector are significant. The merger raises questions about national identity, economic independence, and the long-term sustainability of Canadian industries. The government's decision will be closely watched as a measure of its commitment to protecting Canadian interests in a globalized economy.