What is the story about?

What's Happening?

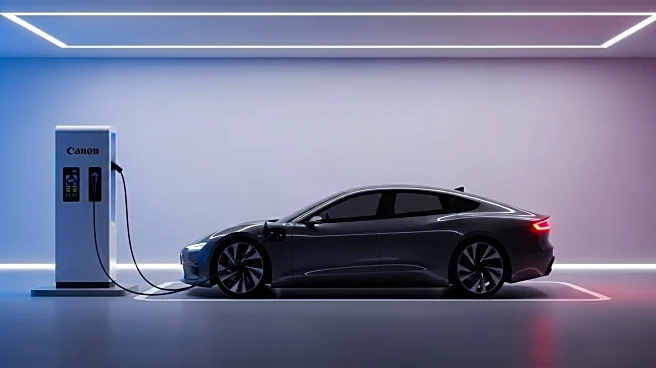

Tesla has reported a 7% increase in electric vehicle sales for the last quarter, driven by a rush to purchase before the expiration of a federal $7,500 tax credit. This surge in sales marks a rebound for Tesla, which has faced declining sales and brand challenges earlier this year. The increase in sales is part of a broader trend in the electric vehicle market, with other brands like Cadillac also experiencing a rise in sales. Despite the positive sales figures, Tesla's stock saw a decline, reflecting ongoing market challenges.

Why It's Important?

The expiration of the federal tax credit has created a temporary boost in electric vehicle sales, benefiting manufacturers like Tesla. However, the end of the credit may lead to a slowdown in sales, impacting the broader EV market. Tesla's ability to capitalize on this surge is crucial for its financial health, especially as it navigates challenges such as market saturation and political controversies involving its CEO, Elon Musk. The situation highlights the importance of government incentives in promoting electric vehicle adoption.

What's Next?

With the tax credit now expired, Tesla and other EV manufacturers may face a decline in sales. Tesla's future strategy will likely focus on its autonomous driving technology and robotaxi ventures to drive growth. The company will need to address challenges in its self-driving efforts to successfully roll out these initiatives. The broader EV market will also need to adapt to changing consumer incentives and market conditions.

Beyond the Headlines

Tesla's recent sales increase underscores the impact of government policies on consumer behavior and market dynamics. The company's reliance on tax incentives raises questions about the sustainability of its business model in the absence of such support. Additionally, Tesla's brand challenges, partly due to its CEO's political involvement, highlight the complex interplay between corporate leadership and public perception.