What's Happening?

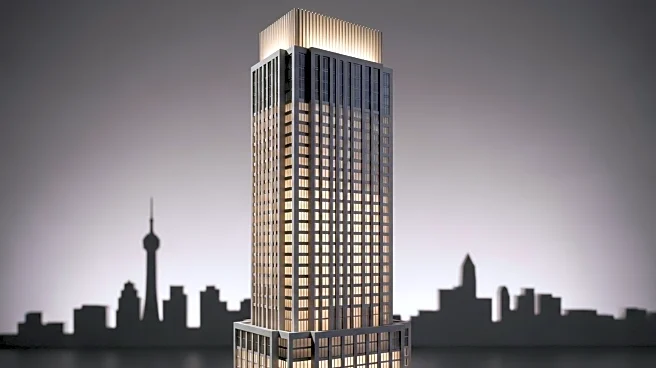

Vanbarton Group LLC, a real estate investment and advisory firm, has acquired an office building located at 6 E. 43rd St. in Midtown Manhattan for $135 million. The acquisition was facilitated by Greenberg Traurig, LLP, a global law firm that represented Vanbarton and its investment partners. The firm plans to convert the 27-story building into 441 rental apartments, with approximately 25% of the units designated for affordable housing. In addition to the acquisition, Greenberg Traurig assisted Vanbarton in securing a $300 million loan from Brookfield to finance both the purchase and the redevelopment of the property. The legal team involved in the transaction included Real Estate Shareholders Gary S. Kleinman and Adam M. Goldstein, along with New York Real Estate Associates Zachary E. Schelberg and Amanda L. Rudolf.

Why It's Important?

This acquisition and planned conversion reflect a significant trend in urban real estate development, where office spaces are being repurposed for residential use. The inclusion of affordable housing units is particularly noteworthy, as it addresses the growing demand for accessible housing in New York City. The involvement of Greenberg Traurig, a prominent law firm, underscores the complexity and scale of such real estate transactions. The financing from Brookfield further highlights the confidence in the project's potential to contribute positively to the city's housing market. This development could set a precedent for similar conversions in other urban areas, potentially influencing real estate investment strategies and urban planning policies.

What's Next?

The next steps for Vanbarton Group involve the detailed planning and execution of the building's conversion into residential apartments. This process will likely involve obtaining necessary permits and approvals from city authorities, as well as coordinating with construction and design teams to ensure the project meets regulatory standards and market expectations. Stakeholders, including local government and community groups, may engage in discussions regarding the impact of the conversion on the neighborhood, particularly concerning the affordable housing component. The success of this project could encourage further investments in similar conversions, potentially reshaping the real estate landscape in urban centers.

Beyond the Headlines

The conversion of office buildings into residential spaces raises broader questions about the future of urban development and the balance between commercial and residential needs. As remote work becomes more prevalent, the demand for office space may continue to decline, prompting more developers to consider residential conversions. This shift could lead to changes in zoning laws and urban planning strategies, as cities adapt to new living and working patterns. Additionally, the emphasis on affordable housing in such projects highlights ongoing social and economic challenges, including income inequality and housing affordability, which are critical issues in many metropolitan areas.