What's Happening?

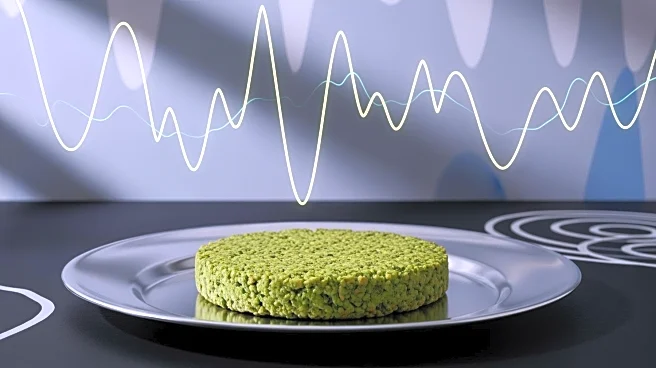

Beyond Meat experienced a significant drop in its stock value, plummeting 11.4% in after-hours trading. This decline follows a period of intense retail-investor activity that had previously driven the

company's shares up by as much as 1,479% over the past week. The volatility in Beyond Meat's stock is part of a broader trend affecting meme stocks and tech megacaps. Tesla also saw a 3.8% decrease in its share price after reporting profits that did not meet analysts' expectations, despite achieving record third-quarter revenue. Netflix's stock fell by over 10% due to investor dissatisfaction with its outlook for the upcoming quarter. Despite these setbacks, most companies reporting have exceeded analysts' estimates, contributing to a slight recovery in S&P 500 e-mini futures, which edged up 0.2% in Asian trading.

Why It's Important?

The fluctuations in Beyond Meat's stock highlight the impact of retail-investor behavior on market dynamics, particularly in the context of meme stocks. The broader market volatility, including declines in major tech companies like Tesla and Netflix, underscores the challenges faced by investors in navigating earnings reports and market expectations. These developments have implications for U.S. financial markets, influencing investor sentiment and potentially affecting investment strategies. The performance of these companies can have ripple effects on related industries and sectors, impacting economic stakeholders and shaping market trends.

What's Next?

Investors and market analysts will be closely monitoring upcoming earnings reports from major companies such as Intel Corporation, T-Mobile US Inc, and Blackstone Inc, which could further influence market movements. Additionally, economic data releases from France and the U.K. may provide insights into broader economic conditions, potentially affecting market sentiment. The White House's consideration of export restrictions to China and sanctions on Russian oil companies could also have significant geopolitical and economic implications, influencing global trade and energy markets.

Beyond the Headlines

The recent market volatility raises questions about the sustainability of retail-investor-driven stock surges and the potential for regulatory scrutiny. The interplay between geopolitical tensions, such as U.S.-China trade relations and sanctions on Russia, adds complexity to market dynamics, with potential long-term impacts on global economic stability and trade policies.