What's Happening?

Insurance companies are losing potential customers due to friction-laden authentication processes at the login screen. A report from McKinsey highlights that over 30% of customers are dissatisfied with digital channels, and only 20% prefer digital interactions with insurers. This dissatisfaction is leading to lost revenue and damaged trust as customers turn to competitors offering seamless access. Insurers are concerned about security vulnerabilities, especially with outdated methods like SMS codes for multi-factor authentication, which are susceptible to SIM swapping. The industry is urged to adopt passwordless options such as passkeys and magic links to enhance security and improve customer experience.

Why It's Important?

The insurance industry is at a critical juncture where modernizing authentication processes can significantly impact customer retention and business growth. As cyber threats evolve, insurers must balance security with user experience to maintain competitiveness. The shift towards passwordless authentication methods not only addresses security concerns but also enhances customer satisfaction, potentially reversing the trend of customer loss. Insurers that fail to adapt may see their market share erode as consumers opt for more user-friendly alternatives.

What's Next?

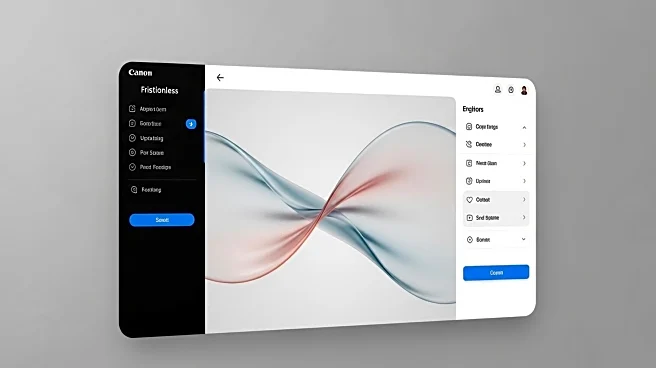

Insurers are expected to gradually integrate new authentication technologies alongside legacy systems to minimize disruption. The adoption of agentic artificial intelligence in insurance systems will necessitate robust authorization controls to prevent privacy breaches and fraud. As regulatory standards evolve, insurers must expand their authentication frameworks to include AI agents, ensuring compliance and security. The industry will likely see increased investment in technology to streamline digital interactions and improve customer retention.