What's Happening?

Wedbush Securities has reiterated its 'Outperform' rating on Tesla, Inc., setting a $600 price target ahead of the company's third-quarter earnings report. Analyst Daniel Ives anticipates this quarter to

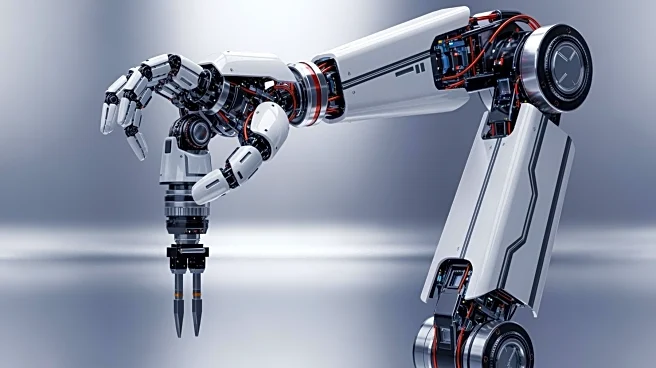

signify a pivotal shift for Tesla as it advances into the 'AI transformation' era, driven by its autonomous driving and robotics initiatives. The upcoming earnings are expected to reflect stable demand trends, bolstered by Model Y refreshes and a recovery in the Chinese market. Wall Street forecasts Q3 revenue to be around $26 billion, with automotive sales contributing $19 billion. Tesla's Robotaxi rollout and Optimus production roadmap are seen as crucial for long-term growth, potentially adding $1 trillion to Tesla's valuation in the coming years.

Why It's Important?

Tesla's transition into AI and robotics is significant for the automotive and technology sectors, potentially redefining the company's market position and valuation. The focus on autonomous vehicles and robotics could lead to substantial growth, with Wedbush projecting Tesla's market capitalization to reach $2 trillion by early 2026. This shift could influence the broader industry, prompting competitors to accelerate their own AI and autonomous technology developments. Additionally, Tesla's performance in China, a key market, underscores the importance of international sales in its growth strategy. The anticipated stabilization in demand and potential earnings beat could boost investor confidence and impact stock performance.

What's Next?

Tesla's upcoming shareholder meeting on November 6 will be pivotal, with investors voting on Elon Musk's proposed $1 trillion pay package. This meeting is expected to outline Tesla's major investment in xAI, a critical component of its AI strategy. The company's continued focus on AI and robotics could lead to further innovations and market expansion. Stakeholders will be closely monitoring Tesla's ability to maintain momentum in its autonomous and robotics initiatives, as well as its performance in key markets like China. The outcome of the shareholder meeting and subsequent strategic decisions will likely influence Tesla's trajectory in the AI and automotive sectors.

Beyond the Headlines

Tesla's push into AI and robotics raises ethical and regulatory considerations, particularly concerning autonomous vehicle safety and data privacy. As Tesla advances its technology, it may face increased scrutiny from regulators and the public. The company's ability to navigate these challenges while maintaining innovation will be crucial. Additionally, Tesla's strategy could set a precedent for other automakers, potentially leading to broader industry shifts towards AI-driven solutions. The long-term implications of Tesla's AI initiatives could extend beyond the automotive sector, influencing technology development and regulatory frameworks globally.