What's Happening?

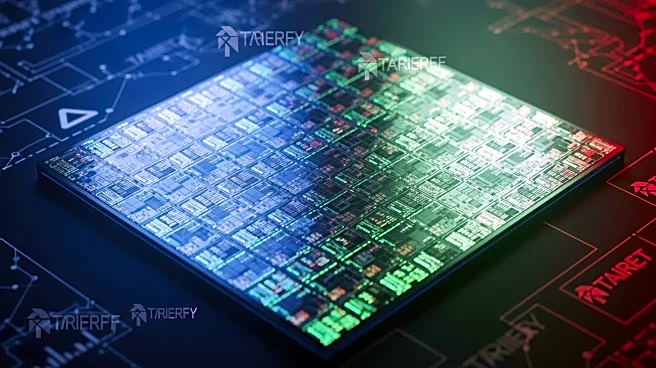

Taiwan Semiconductor Manufacturing Co (TSMC) has announced a significant 39.1% increase in its third-quarter net profit, driven by robust demand for its advanced AI chips. The company, recognized as the

world's largest producer of AI chips, forecasts a potential 24% rise in fourth-quarter revenue, marking its sixth consecutive quarter of double-digit profit growth. Despite these positive financial results, TSMC remains cautious about the potential impact of US trade tariffs on its business operations. The company has maintained its capital spending forecast at up to $42 billion for 2025, reflecting its commitment to growth amid geopolitical uncertainties. TSMC's shares have risen 38% this year, outperforming the broader market, which has seen a 20% increase.

Why It's Important?

TSMC's financial performance underscores the growing importance of AI technology in the semiconductor industry. As demand for AI applications continues to surge, companies like TSMC are positioned to benefit significantly. However, the looming threat of US trade tariffs presents a challenge that could affect global supply chains and pricing strategies. The company's cautious approach to business planning highlights the delicate balance between capitalizing on technological advancements and navigating geopolitical tensions. Stakeholders, including major customers like Nvidia and Apple, may face uncertainties in supply and pricing, potentially impacting their operations and market strategies.

What's Next?

TSMC's strategic planning for 2026 will likely focus on mitigating risks associated with US trade policies while continuing to invest in AI technology. The company's announced $100 billion US investment, including three plants in Arizona, signifies its commitment to expanding its footprint in the US market. As geopolitical tensions evolve, TSMC may need to adapt its strategies to ensure sustained growth and stability. Industry observers will be watching closely for any shifts in trade policies that could impact TSMC and its competitors, such as Samsung Electronics, which also reported strong profits due to AI demand.

Beyond the Headlines

The broader implications of TSMC's performance and strategic decisions extend to the global semiconductor industry, which is increasingly influenced by AI technology. The company's investments in the US and its cautious approach to tariffs reflect a strategic alignment with major economic powers. This alignment may influence future trade negotiations and industry standards, potentially reshaping the competitive landscape. Additionally, the focus on AI technology highlights the ethical considerations surrounding data privacy and security, as these chips become integral to various applications.