What's Happening?

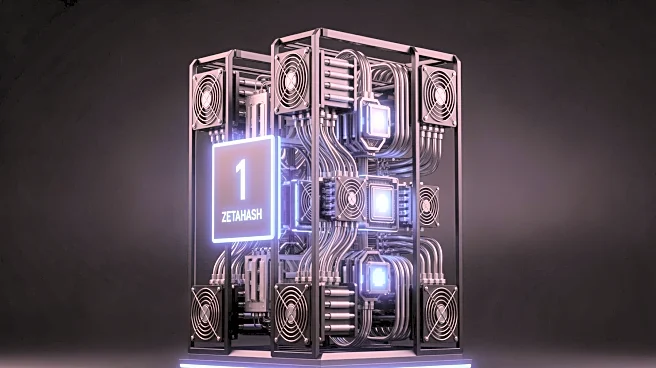

Bitcoin mining has reached a significant milestone, crossing the zetahash threshold in September with the network averaging 1.034 ZH/s. This development coincides with a rise in miners' equity values,

which nearly doubled from August to mid-October, despite a 3.7% drop in Bitcoin's value. The sector is now focusing on balance sheet capacity, convertible debt, and high-performance computing contracts. The increased difficulty in mining has squeezed operating margins, while power costs remain high. The market capitalization of listed operators rose from $41 billion in August to $90 billion by mid-October. This shift reflects a narrative of digital-infrastructure exposure, with miners presenting contracted power and data-center buildouts as new revenue streams.

Why It's Important?

The shift towards a debt-fueled model in Bitcoin mining highlights the increasing financialization of the sector. As miners seek to expand their operations and improve efficiency, they are turning to convertible debt and high-performance computing contracts. This trend could lead to greater consolidation in the industry, as smaller operators may struggle to compete with larger, better-financed companies. The focus on non-mining revenue streams, such as AI colocation, indicates a diversification strategy that could stabilize earnings and reduce reliance on volatile Bitcoin prices. However, the increased financial leverage also introduces risks, as companies may face challenges in refinancing or converting debt if equity momentum slows.

What's Next?

The future of Bitcoin mining will likely involve further consolidation and strategic partnerships, as operators seek to leverage their infrastructure for non-mining revenue. The industry may also see increased regulatory scrutiny, particularly in jurisdictions with high energy consumption. As miners continue to expand their capacity, the network's difficulty is expected to rise, potentially impacting profitability. Companies will need to balance growth with financial stability, ensuring they can manage debt obligations while investing in new technologies and infrastructure.