What's Happening?

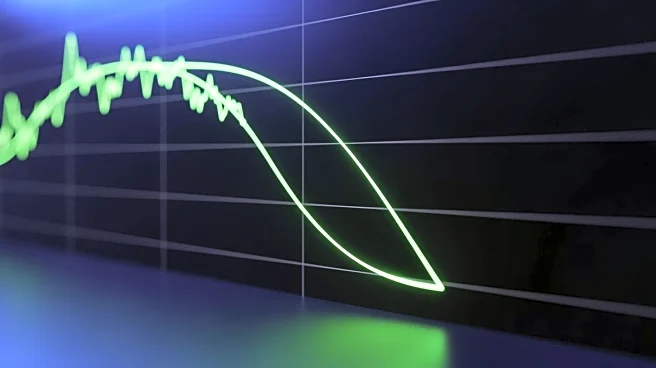

U.S. Treasury yields fell on Tuesday as investors prepared for the release of delayed jobs data following the end of a 43-day government shutdown. The 2-year Treasury note yield dropped by more than 4 basis

points to 3.568%, while the 30-year bond yield fell more than 1 basis point to 4.717%. The 10-year Treasury yield, a benchmark for U.S. government borrowing, decreased by almost 3 basis points to 4.104%. The longest government shutdown in history has resulted in a data blackout, complicating the economic outlook and affecting expectations for a potential interest rate cut by the Federal Reserve in December.

Why It's Important?

The decline in Treasury yields reflects investor uncertainty as they await crucial economic indicators that could shape future monetary policy decisions. The delayed release of jobs data, including the trade balance for August and the Bureau of Labor Statistics' nonfarm payrolls report for September, will provide insights into the U.S. economic situation post-shutdown. These indicators are vital for assessing the health of the economy and guiding Federal Reserve policy. The outcome could influence interest rates, impacting borrowing costs for businesses and consumers, and potentially affecting economic growth.

What's Next?

Investors are closely monitoring the upcoming economic data releases to navigate the uncertainty caused by the shutdown. The ADP Employment Change Weekly report, scheduled for Tuesday, will offer a snapshot of employment in the U.S. private sector. Following this, the trade balance and nonfarm payrolls reports will be released, providing further clarity on the economic landscape. The Federal Reserve's future actions regarding interest rates will likely depend on these data points, with potential implications for financial markets and economic policy.