What's Happening?

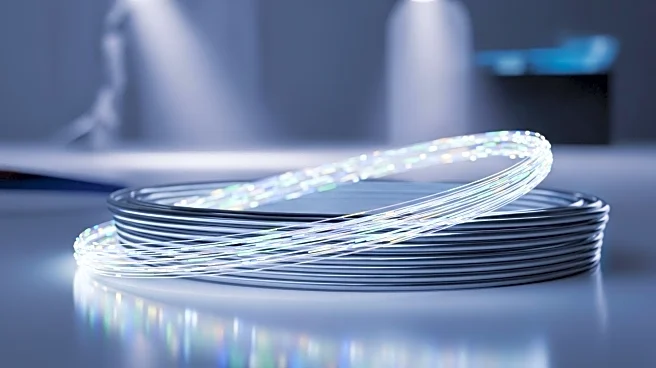

EQT, a Swedish private equity firm, has begun the process of selling GlobalConnect, a leading Nordic broadband and data center platform. The sale, managed by Goldman Sachs, could value GlobalConnect at approximately €8 billion. EQT acquired a majority stake in GlobalConnect in 2017 and has since expanded it into one of Northern Europe's largest digital infrastructure operators, with extensive fiber networks across several countries.

Why It's Important?

The sale of GlobalConnect represents one of the largest digital infrastructure transactions in Europe this year. It highlights the growing value and importance of digital infrastructure in the modern economy, as well as the strategic moves by private equity firms to capitalize on these assets. The transaction could influence market dynamics in the digital infrastructure sector, potentially affecting service availability and pricing for consumers and businesses in the region.

What's Next?

As the sale process unfolds, potential buyers will likely emerge, including other private equity firms and strategic investors interested in expanding their digital infrastructure portfolios. The outcome of the sale could set a precedent for future transactions in the sector, influencing valuations and investment strategies.