What's Happening?

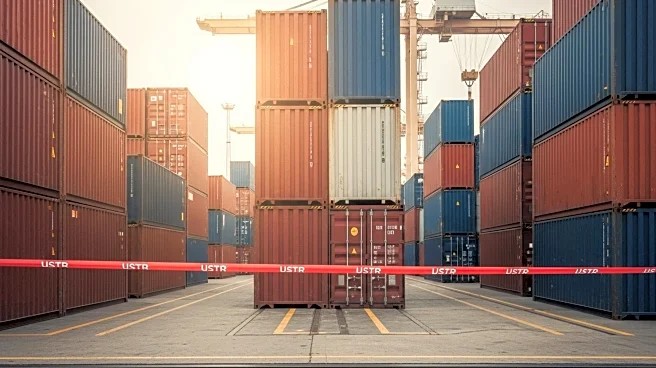

The U.S. Trade Representative's port fee program is set to begin on October 14, targeting Chinese-owned, operated, or built ships. This initiative, originally proposed by the Trump administration, aims to counteract Chinese dominance in the maritime sector. The program follows an investigation by the Biden administration, prompted by U.S. trade unions, which identified unfair business practices and government support for China's shipbuilding industry. BIMCO, an industry trade group, has analyzed the program's potential impact, predicting that bulk carriers will be most affected, with 45% potentially subject to fees. Overall, BIMCO estimates that a third of ships calling at U.S. ports could incur fees, affecting nearly half of the combined capacity of bulkers, crude and product tankers, and container fleets.

Why It's Important?

The implementation of the USTR fee program is significant as it could reshape maritime trade dynamics between the U.S. and China. By imposing fees on Chinese maritime assets, the program seeks to reduce Chinese influence in the sector, potentially leading to shifts in global shipping routes and strategies. U.S. importers and exporters might experience changes in freight rates, although BIMCO suggests that significant rate increases may be avoided. The program could also prompt Chinese carriers to adjust their operations, possibly withdrawing from U.S. trades to maintain competitiveness. This development may influence broader trade relations between the two countries, impacting industries reliant on maritime imports and exports.

What's Next?

As the program commences, stakeholders are likely to seek further clarification on the definitions of Chinese-owned and operated vessels. The industry anticipates potential confusion and delays, especially as shippers rush imports before the November 10 deadline for tariff delays on Chinese goods. Customs & Border Protection has advised operators to pay fees online in advance to avoid denials at U.S. ports. Retailers forecast a decline in container import volumes, influenced by the fee program and tariff deadlines. The maritime sector may witness strategic adjustments, including refinancing and changes in vessel ownership structures, to mitigate the program's impact.

Beyond the Headlines

The fee program could have deeper implications for global maritime trade, particularly in the bulker and tanker segments. While BIMCO suggests minimal global impact, the program may encourage shifts in vessel deployment and ownership strategies. Additionally, the program's focus on Chinese maritime assets highlights ongoing geopolitical tensions and trade disputes between the U.S. and China. The initiative may also prompt discussions on fair trade practices and government support in the global shipping industry, influencing future policy decisions.