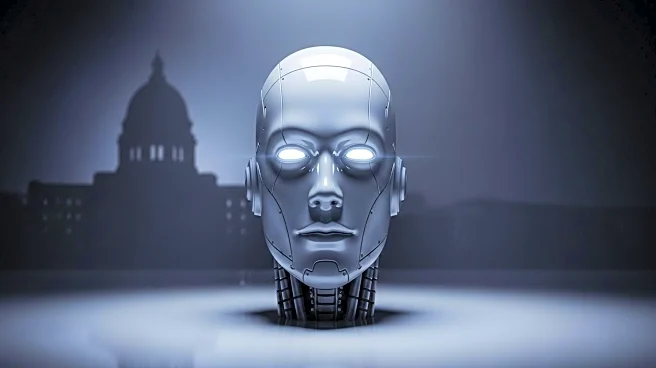

What's Happening?

The S&P 500 experienced a decline on Tuesday, primarily influenced by a significant drop in Oracle shares. Investors expressed concerns over Oracle's profitability in its artificial intelligence rollout, particularly regarding its cloud business margins and losses on Nvidia chip rentals. Oracle's shares fell over 5%, impacting the Nasdaq Composite, which dropped by 0.7%. The Dow Jones Industrial Average also decreased by 105 points, or 0.2%. Additionally, the ongoing U.S. government shutdown, now in its second week, contributed to market uncertainty. The Senate failed to pass a funding bill, with President Trump blaming Democrats for the impasse. The shutdown has delayed key economic data releases, including the September jobs report, affecting the Federal Reserve's decision-making process.

Why It's Important?

The decline in the S&P 500 highlights investor concerns about the profitability of AI investments, particularly in the tech sector. Oracle's struggles may prompt a reassessment of expectations regarding AI's financial returns. The government shutdown adds another layer of uncertainty, affecting economic data availability and potentially influencing Federal Reserve policy decisions. The shutdown's impact on furloughed workers and active-duty military personnel could increase pressure on Congress to reach an agreement. The situation underscores the interconnectedness of political developments and market dynamics, with potential implications for economic stability and investor confidence.

What's Next?

As the government shutdown continues, pressure may mount on Congress to resolve the funding impasse, especially as furloughed workers and military personnel face delayed paychecks. Investors will likely monitor developments closely, seeking clarity on economic data releases and Federal Reserve actions. The tech sector may experience further scrutiny as companies like Oracle navigate AI profitability challenges. Stakeholders will watch for potential shifts in investment strategies and market sentiment, particularly in safe-haven assets like gold, which recently hit record highs.

Beyond the Headlines

The ongoing government shutdown and AI profitability concerns raise broader questions about the sustainability of current economic and technological trends. The shutdown's impact on data availability could hinder informed policy decisions, while AI investment challenges may prompt ethical and strategic considerations regarding technology deployment. These developments may influence long-term shifts in market behavior and public policy, highlighting the need for adaptive strategies in both political and economic spheres.