What's Happening?

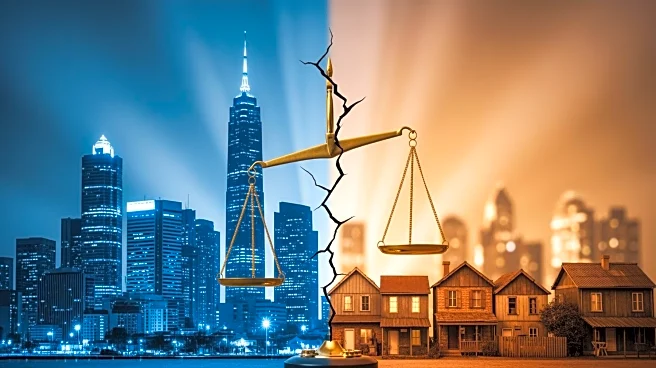

The Federal Reserve is expected to lower interest rates again on October 29, following a previous cut last month. The anticipated reduction is a quarter-point decrease, which would adjust the federal funds target range to 3.75% to 4.00%. Despite the potential

financial benefits, a survey by WalletHub indicates that nearly two-thirds of Americans feel indifferent or unhappy about the rate cuts. The survey, conducted with 200 participants, revealed that 59% believe the cut will not significantly impact their lives. The rate cut could save consumers billions in credit card interest and slightly reduce the average APR on new car loans. However, concerns about inflation overshadow the potential benefits, with 93% of respondents viewing inflation as a significant issue.

Why It's Important?

The Federal Reserve's decision to cut rates is aimed at supporting a slowing labor market and stimulating economic activity. Lower interest rates can reduce borrowing costs, potentially increasing consumer spending and investment. However, the public's indifference suggests that the benefits may not be felt widely, possibly due to existing high levels of personal debt and selective lending practices. The rate cut could save consumers approximately $1.92 billion in credit card interest over the next year, but the persistent concern over inflation remains a significant economic challenge. The balance between stimulating the economy and controlling inflation is delicate, and rapid rate cuts could inadvertently fuel inflationary pressures.

What's Next?

The Federal Reserve is expected to implement another rate cut at its December 10 meeting, further lowering the target range to 3.50% to 3.75%. This move will be closely watched by economic stakeholders, as it could influence consumer spending and borrowing patterns. The ongoing government shutdown has delayed the release of key inflation data, which could impact future monetary policy decisions. The Bureau of Labor Statistics plans to release September inflation data on October 24, which will be crucial for calculating Social Security cost-of-living adjustments. The economic outlook remains uncertain, with inflation and job market concerns continuing to dominate public sentiment.