What's Happening?

Intuitive Surgical's stock experienced a significant surge, rising 17% in after-hours trading following a strong Q3 earnings report. The company reported a 23% year-over-year increase in revenue, reaching $2.51 billion, and an adjusted EPS of $2.40, surpassing

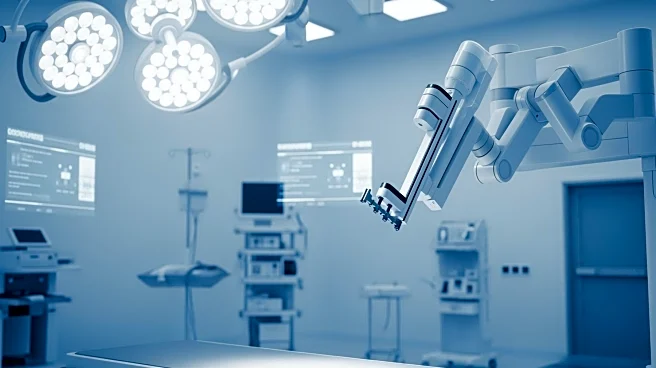

analyst expectations. The growth was driven by a 19% increase in global da Vinci procedures and a 52% rise in Ion procedures. Intuitive Surgical placed 427 new da Vinci robots, including 240 of the latest da Vinci 5 models. The company raised its full-year 2025 procedure growth guidance and slightly increased its gross margin expectations.

Why It's Important?

Intuitive Surgical's strong performance highlights the growing demand for surgical robotics, a sector expected to grow at a 28% CAGR through 2029. The company's leadership in robotic surgery positions it well to capitalize on this trend, despite increasing competition from Medtronic and Johnson & Johnson. The positive earnings report and raised guidance reflect confidence in Intuitive's ability to maintain its market dominance. The stock's surge indicates strong investor sentiment and potential for continued growth, benefiting shareholders and the broader medtech industry.

What's Next?

Intuitive Surgical plans to continue expanding its da Vinci and Ion platforms, focusing on increasing procedure adoption and enhancing patient care. The company is hosting investor meetings to discuss its strategic outlook, which may further influence stock performance. The competitive landscape is evolving, with new entrants like Medtronic's Hugo and J&J's Ottava robots challenging Intuitive's market position. Regulatory approvals and product innovations will be key factors in maintaining growth momentum.

Beyond the Headlines

The surgical robotics sector's expansion reflects broader trends in healthcare automation and AI integration. Intuitive's focus on improving patient outcomes aligns with industry goals of enhancing efficiency and precision in medical procedures. The company's ability to navigate tariffs and international market dynamics will be crucial in sustaining its competitive edge. The evolving competitive landscape may lead to longer sales cycles as hospitals evaluate new options, impacting market dynamics.