What's Happening?

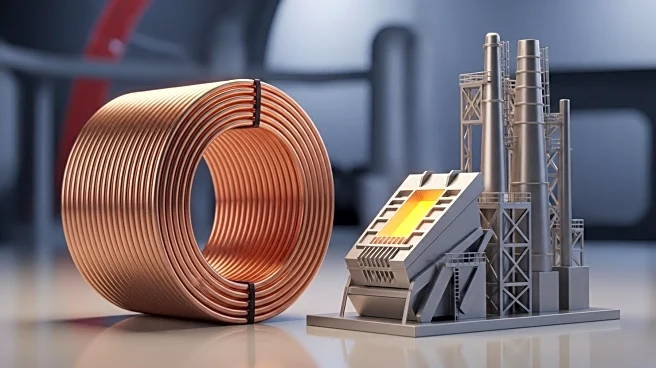

Ivanhoe Electric Inc. has announced a significant increase in its copper production, reporting a 57% rise in the third quarter to 71,226 tons. The company maintains its full-year guidance of 370,000 to 420,000 tons. Additionally, Ivanhoe Electric is preparing to launch operations at Africa's largest direct-to-blister copper smelter, which is expected to reduce operational cash costs. These developments have contributed to a 15.8% surge in the company's stock price, reflecting renewed market confidence in its operational milestones and full-year targets.

Why It's Important?

The increase in copper production and the upcoming smelter launch are pivotal for Ivanhoe Electric's investment narrative, as they suggest potential cost reductions and improved margins. This is crucial for the company as it seeks to move towards profitability. The stock surge indicates market optimism about these operational milestones. However, Ivanhoe Electric remains unprofitable, with high cash burn and limited revenue, posing risks such as running out of cash or failing to meet output targets. Investors must weigh these factors when considering the company's future prospects.

What's Next?

Ivanhoe Electric's focus will likely remain on operational execution to capitalize on the increased copper output and the smelter launch. The company aims to achieve profitability by reducing costs and improving margins. Investors will be closely monitoring the company's ability to meet its full-year production targets and manage its cash flow effectively. The success of these initiatives could further bolster market confidence and drive stock performance.

Beyond the Headlines

The developments at Ivanhoe Electric highlight broader industry trends, such as the importance of cost management and operational efficiency in the mining sector. The company's efforts to launch an environmentally advanced smelter also reflect growing industry emphasis on sustainable practices. These factors could influence long-term shifts in mining operations and investment strategies.