What is the story about?

What's Happening?

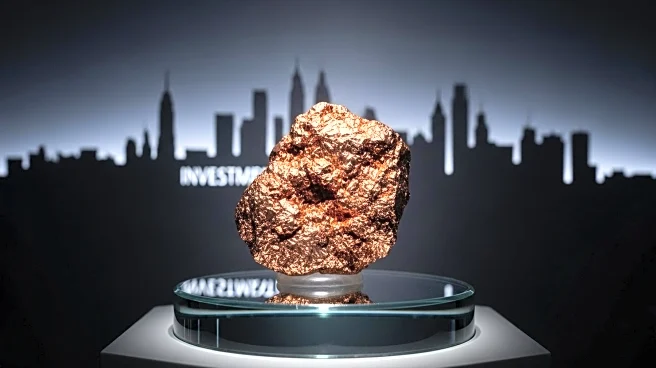

BHP, the world's largest mining company, emphasized its copper growth prospects and the investment appeal of the United States during a shareholder briefing. CEO Mike Henry and CFO Vandita Pant discussed the company's focus on organic growth from its copper assets in Argentina, the U.S., Chile, and South Australia. They also noted production delays at BHP's Jansen potash project in Canada. Despite recent industry mergers, BHP remained silent on potential major acquisitions, focusing instead on expanding its existing copper operations.

Why It's Important?

BHP's focus on copper growth aligns with the increasing demand for copper, driven by the global energy transition and electrification efforts. Copper is essential for renewable energy technologies and electric vehicles, making it a strategic resource for the future. The company's emphasis on U.S. investment highlights the country's competitive advantages, such as lower power costs, which could attract further mining investments. BHP's strategy to expand its copper assets without pursuing major acquisitions reflects a cautious approach amid industry consolidation.

What's Next?

BHP's continued investment in copper assets may lead to increased production capacity and enhanced market position in the copper industry. The company's focus on organic growth could result in strategic partnerships or joint ventures to optimize resource development. As BHP navigates production challenges at its Jansen project, it may explore operational improvements or alternative strategies to meet its investment goals. The mining sector will closely watch BHP's actions, as they could influence industry trends and competitive dynamics.