What's Happening?

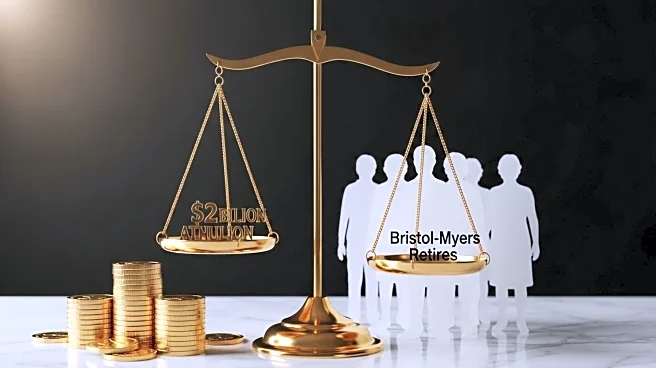

A New York judge has ruled that a lawsuit filed by former Bristol-Myers Squibb employees can proceed. The plaintiffs, led by former employee Charles Doherty, argue that the conversion of their pensions into Athene annuities poses a risk to their retirement earnings. The lawsuit claims that Bristol-Myers Squibb, along with its fiduciary State Street Global Advisors Trust Co., failed to select the safest insurer when entering a $2 billion pension risk transfer (PRT) deal with Athene Annuity Life Co. The plaintiffs describe Athene as a 'highly risky' insurer. District Judge Margaret M. Garnett denied motions to dismiss the case, stating that the plaintiffs have sufficiently alleged that the transaction with Athene creates a substantial risk of not receiving their benefits.

Why It's Important?

This ruling is significant as it highlights the ongoing legal scrutiny of pension risk transfer deals, which are becoming more common among large corporations. The decision could impact how companies manage pension liabilities and the selection of insurers for such transactions. If the plaintiffs succeed, it may lead to stricter regulations and oversight in the pension industry, potentially affecting the financial strategies of major corporations. The case also underscores the tension between corporate cost-cutting measures and the financial security of retirees, raising questions about fiduciary responsibilities and the protection of employee benefits.

What's Next?

The case may set a precedent for similar lawsuits, as several other companies, including AT&T and Lockheed Martin, have faced legal challenges over PRT deals. The differing judicial opinions in similar cases, such as the recent dismissal of a lawsuit against General Electric, suggest that the issue could eventually reach the Supreme Court. The outcome of this case could influence future corporate decisions regarding pension management and the legal framework governing such transactions.