What's Happening?

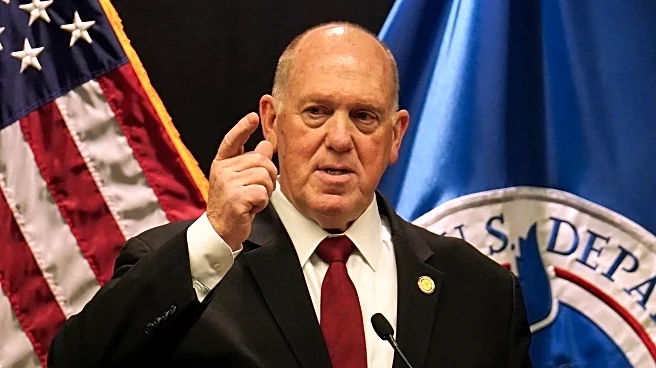

The Ontario government has received an audit report on the now-defunct iPro Realty, conducted by the law firm Dentons. The Real Estate Council of Ontario (RECO) has shared the report with Stephen Crawford, the minister of public and business service delivery

and procurement. The report's findings are not yet public, pending review by the ministry. This audit follows RECO's interim report in October, which came after the discovery of $10.5 million allegedly withdrawn illegally from iPro's trust accounts. The company has since repaid $3 million, and its co-founders have agreed not to apply for brokerage certification again. The Ontario Provincial Police are investigating, and iPro's assets have been frozen by a court.

Why It's Important?

The audit report is significant as it addresses the financial misconduct allegations against iPro Realty, which has drawn criticism towards RECO for its handling of the situation. The case highlights potential regulatory gaps in the real estate sector, particularly concerning self-regulation. Industry experts are calling for increased oversight and transparency, fearing that the current self-regulatory model may not effectively prevent such incidents. The outcome of this audit could influence future regulatory reforms in Ontario's real estate industry, impacting how trust accounts are managed and monitored.

What's Next?

The public awaits the release of the audit findings, which could prompt further legal and regulatory actions. There is pressure on RECO to improve its oversight mechanisms, and the case may lead to calls for independent governance of real estate regulators. The ongoing investigation by the Ontario Provincial Police and potential legal actions against iPro's co-founders could result in significant legal precedents for the industry.

Beyond the Headlines

The iPro Realty case underscores the challenges of self-regulation in the real estate industry. It raises questions about the effectiveness of current oversight mechanisms and the potential need for a shift towards more independent regulatory bodies. The situation also highlights the ethical responsibilities of real estate professionals in managing client funds and the importance of maintaining public trust in the industry.