What's Happening?

In 2025, China's manufacturing sector is experiencing mixed signals due to U.S. tariffs. The official Purchasing Managers’ Index (PMI) has been below the growth threshold for five months, indicating weak domestic demand. However, the Caixin China General Manufacturing PMI, which focuses on export-oriented firms, rose to 50.5 in August, marking its first expansion in three months. This suggests that while domestic manufacturing struggles, export-driven segments remain resilient. The Caixin PMI's strength is attributed to its focus on smaller, export-focused firms that have adapted to U.S. tariffs by shifting to non-U.S. markets and high-value products. Despite a 21.6% drop in exports to the U.S. in July, China's overall trade surplus reached a record $586 billion in the first half of 2025.

Why It's Important?

The resilience of China's export-driven manufacturing sector has significant implications for global trade dynamics and U.S. economic interests. As Chinese firms adapt to U.S. tariffs by diversifying markets and focusing on high-value products, they maintain a competitive edge in global supply chains. This adaptability could challenge U.S. manufacturers and exporters, potentially leading to shifts in market share. Additionally, the ongoing U.S.-China tariff tensions highlight the fragility of international trade relations, which could impact global economic stability. For U.S. businesses, the situation underscores the need to reassess supply chain strategies and explore alternative sourcing options.

What's Next?

The future of U.S.-China trade relations remains uncertain, with the potential for further tariff escalations. The recent extension of a 90-day tariff truce provides temporary stability, but underlying tensions persist. U.S. imports of Chinese goods have already declined, and continued tariff pressures could further erode China's market share. Stakeholders, including businesses and policymakers, will need to monitor developments closely and prepare for potential disruptions. The situation may also prompt increased diplomatic efforts to negotiate more sustainable trade agreements.

Beyond the Headlines

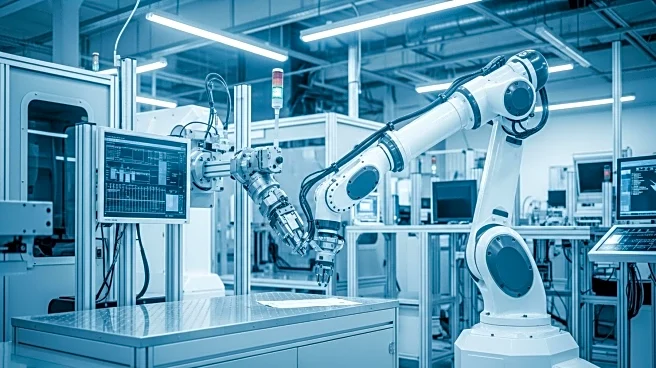

The ongoing trade tensions between the U.S. and China could have long-term implications for global economic structures. As China strengthens its trade ties with other regions, such as Southeast Asia and the EU, it may shift the balance of economic power. This could lead to new alliances and trade agreements that bypass traditional U.S. influence. Additionally, the focus on high-value products like semiconductor components highlights the strategic importance of technology and innovation in maintaining economic resilience.