What's Happening?

The U.S. District Court for the District of Maryland has issued an opinion requiring SCOTUSblog's Goldstein to face charges in a tax fraud case. This development was reported by Mallory Culhane of Bloomberg

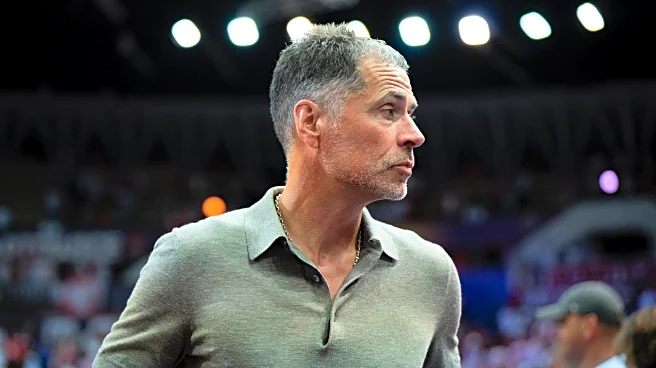

Law. The case involves allegations of tax fraud, which have been brought against Goldstein, a prominent figure associated with SCOTUSblog, a well-known blog dedicated to covering the U.S. Supreme Court. The charges are part of a broader legal scrutiny involving individuals connected to high-profile legal and political entities. The court's decision to proceed with the charges indicates a significant step in the legal process, highlighting the ongoing legal challenges faced by individuals in the legal blogging community.

Why It's Important?

The charges against Goldstein underscore the increasing legal challenges faced by individuals involved in legal commentary and blogging. This case could have broader implications for the legal blogging community, potentially affecting how legal analysts and commentators operate. The outcome of this case may influence the credibility and operational practices of legal blogs, which play a crucial role in informing the public about judicial proceedings. Additionally, the case highlights the legal risks associated with tax compliance for individuals and entities involved in media and commentary, emphasizing the importance of adhering to legal and financial regulations.

What's Next?

As the case proceeds, it is expected that there will be significant legal scrutiny and media attention. The legal community and followers of SCOTUSblog will likely monitor the developments closely, given the blog's influence in legal circles. The outcome of the case could set a precedent for how similar cases are handled in the future, particularly concerning individuals involved in legal commentary. Stakeholders in the legal and media industries may also respond by reviewing their own compliance practices to avoid similar legal challenges.