What's Happening?

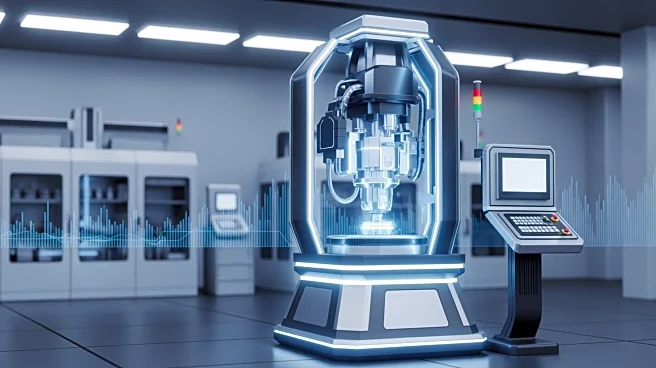

Applied Materials, Inc., a prominent player in the manufacturing sector, is gaining attention as one of the key stocks to watch. The company provides equipment, services, and software to the semiconductor,

display, and related industries, operating through three main segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment is particularly notable for its development, manufacturing, and sale of equipment used in fabricating semiconductor chips or integrated circuits. Alongside Taiwan Semiconductor Manufacturing and Whitehawk Therapeutics, Applied Materials is highlighted due to its cyclical nature, with its earnings and stock prices closely tied to economic cycles. Investors are focusing on metrics such as production capacity, order backlogs, margins, and free cash flow, which are crucial for understanding the company's performance in the context of economic growth, capital spending, commodity costs, and supply-chain conditions.

Why It's Important?

The significance of Applied Materials in the manufacturing sector is underscored by its role in the semiconductor industry, which is vital for technological advancements and economic growth. As a cyclical stock, its performance is closely linked to broader economic conditions, making it a barometer for industry health. The company's focus on semiconductor systems positions it as a critical player in the supply chain for electronics and technology products, impacting various sectors from consumer electronics to automotive industries. Investors and stakeholders in the U.S. economy are keenly observing Applied Materials for insights into manufacturing trends and potential shifts in economic cycles, which could affect capital investments and technological innovation.

What's Next?

As economic conditions fluctuate, Applied Materials and similar manufacturing stocks may experience changes in investor sentiment and market performance. Stakeholders are likely to monitor upcoming financial reports and industry forecasts to gauge the company's resilience and adaptability in the face of economic challenges. Potential developments in semiconductor technology and shifts in global supply chains could further influence the company's strategic direction and market position. Investors may also look for policy changes or economic indicators that could impact manufacturing sectors, affecting Applied Materials' operations and profitability.

Beyond the Headlines

The cyclical nature of manufacturing stocks like Applied Materials raises broader questions about economic stability and the role of technology in driving growth. As industries increasingly rely on advanced semiconductor technologies, the ethical and cultural implications of technological dependency and innovation come into focus. Long-term shifts in manufacturing practices, driven by technological advancements and economic pressures, could redefine industry standards and influence global competitiveness.