What's Happening?

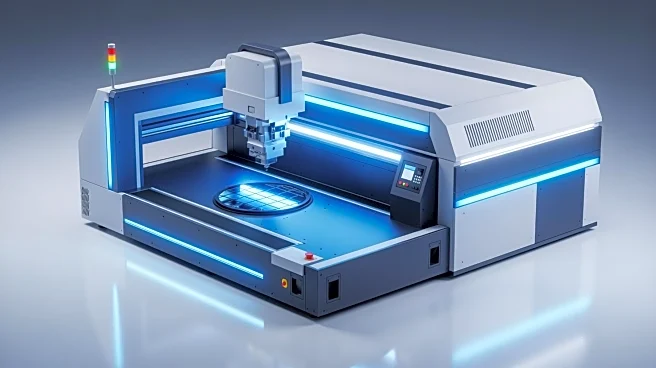

Barclays has upgraded KLA, a prominent wafer fab equipment maker, to overweight from equal weight, raising its price target from $750 to $1,200. This upgrade reflects Barclays' confidence in KLA's position

as a leading player in the semiconductor equipment sector, particularly as investments in artificial intelligence computing bolster the industry. KLA's stock has already surged 76% in 2025, and the bank's forecast suggests an additional 8% rise. Analyst Tom O'Malley highlighted KLA's minimized exposure to Chinese market headwinds compared to its peers, making it a more attractive investment. The analyst also anticipates a 10% growth in KLA's business outside China in 2026, aligning with broader wafer fab equipment market assumptions. Despite mixed analyst opinions, with 17 out of 28 rating it as a hold, KLA's prospects appear promising.

Why It's Important?

The upgrade of KLA by Barclays underscores the growing importance of semiconductor equipment manufacturers in the tech industry, particularly as artificial intelligence investments increase. KLA's reduced exposure to Chinese market risks positions it favorably amidst geopolitical tensions affecting global trade. This development is significant for investors seeking opportunities in the semiconductor sector, which is crucial for technological advancements and economic growth. The anticipated growth in KLA's business outside China highlights potential shifts in market dynamics, offering insights into future industry trends. As semiconductor equipment plays a vital role in tech infrastructure, KLA's performance could influence broader market sentiments and investment strategies.

What's Next?

KLA's upgraded status may attract increased investor interest, potentially driving further stock price appreciation. The company's strategic positioning against Chinese market risks could lead to expanded operations and partnerships in other regions. Analysts and investors will likely monitor KLA's performance closely, assessing its ability to capitalize on AI-driven growth opportunities. The semiconductor equipment sector may experience heightened competition as companies vie for market share, prompting innovation and strategic alliances. KLA's trajectory could serve as a benchmark for evaluating similar companies in the industry, influencing investment decisions and market forecasts.

Beyond the Headlines

KLA's upgrade by Barclays highlights broader implications for the semiconductor industry, including the impact of geopolitical factors on market dynamics. The company's minimized exposure to Chinese market risks suggests potential shifts in global supply chains and trade relations. As AI investments drive demand for semiconductor equipment, ethical considerations regarding data privacy and security may arise, influencing regulatory frameworks. KLA's growth prospects outside China could lead to increased collaboration with international partners, fostering cross-border innovation and technological advancements. The company's performance may also reflect broader economic trends, offering insights into the future of tech-driven industries.