What's Happening?

The average U.S. credit score has dropped to 715, according to FICO's Score Credit Insights, marking a two-point decline from the previous year. This decrease is attributed to persistent inflation and

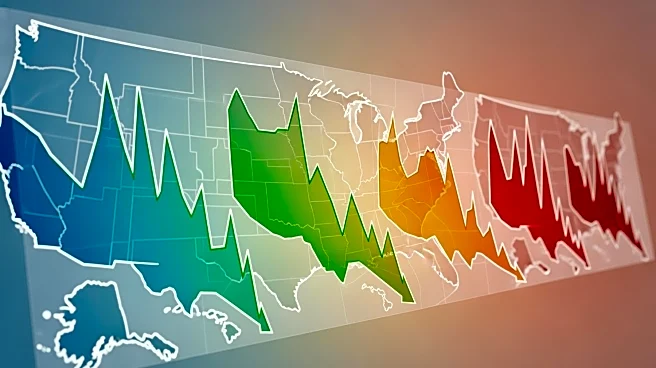

a sluggish job market, which have led to increased credit utilization and decreased on-time payments. The report highlights a growing divide among consumers, with middle-range credit scores shrinking and both excellent and poor scores increasing. State-by-state analysis reveals significant variations, with Mississippi and Louisiana having the lowest average scores, while New Hampshire and Wisconsin boast the highest. Factors such as median income and employment rates are linked to these disparities.

Why It's Important?

The decline in average credit scores has broad implications for U.S. consumers, affecting their ability to secure loans, credit cards, and favorable interest rates. The economic challenges driving this trend, such as inflation and job market instability, underscore the financial pressures facing many Americans. The state-by-state variations highlight regional economic disparities, which can influence local economies and consumer behavior. Understanding these trends is crucial for policymakers, financial institutions, and consumers as they navigate the current economic landscape.

What's Next?

As economic conditions continue to evolve, consumers may need to adopt strategies to improve their credit scores, such as paying bills on time and reducing credit utilization. Financial institutions might adjust lending criteria in response to changing credit score distributions. Policymakers could consider measures to address underlying economic challenges, such as inflation and employment rates, to support consumer financial health. The ongoing analysis of credit score trends will be essential for stakeholders to adapt to these changes.