What's Happening?

The Internal Revenue Service (IRS) has improperly disclosed confidential taxpayer information to the Department of Homeland Security (DHS) as part of a data-sharing agreement aimed at assisting immigration enforcement. This agreement, signed in April

2025, allowed U.S. Immigration and Customs Enforcement (ICE) to submit lists of individuals believed to be in the U.S. illegally, which the IRS would cross-check against its tax records. The IRS confirmed that it shared confidential taxpayer information even when DHS lacked sufficient data to identify individuals positively. The disclosure involved requests for 1.28 million names, with the IRS verifying about 47,000 and providing additional address details for a portion of these individuals. This breach of confidentiality has raised significant privacy concerns and legal challenges.

Why It's Important?

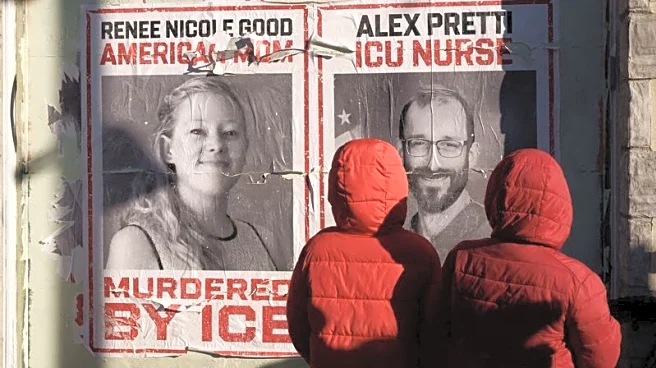

The improper sharing of taxpayer data with DHS highlights critical privacy and legal issues. Federal law imposes strict confidentiality requirements on tax information, and breaches can lead to civil and criminal penalties. This incident undermines public trust in the IRS and the government's ability to safeguard sensitive information. The data-sharing agreement has faced legal challenges, with courts blocking the agreement and ordering the IRS to stop sharing residential address information with ICE. The breach could have severe consequences for individuals whose data was shared, potentially leading to detention, family separation, and identity theft. This situation underscores the importance of maintaining strict legal firewalls to protect taxpayer data.

What's Next?

The IRS and DHS are expected to take steps to remediate the breach, including disposing of improperly shared data. Legal challenges to the data-sharing agreement are likely to continue, with advocacy groups pushing for stronger privacy protections. The IRS may face increased scrutiny and pressure to improve its data handling practices to prevent future breaches. This incident could also prompt legislative action to reinforce taxpayer privacy protections and limit data-sharing agreements between federal agencies. As the situation develops, it will be crucial to monitor the impact on affected individuals and the broader implications for government data-sharing practices.