What's Happening?

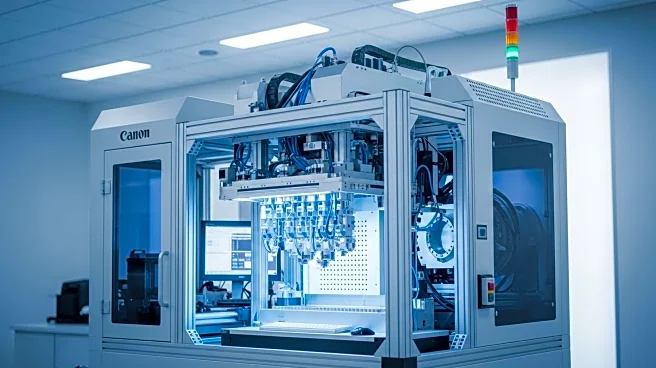

ASML, a leading semiconductor equipment manufacturer, is expected to benefit significantly from a recent $5 billion deal between Nvidia and Intel. According to Bank of America, this partnership will drive demand for ASML's lithography equipment, essential in microchip production. The deal involves Intel integrating its CPUs into Nvidia's AI platforms, which could enhance Intel's competitiveness in data centers and PCs. This collaboration is anticipated to provide Intel with a capital boost, potentially increasing its equipment purchases. ASML's stock has already risen 16% this year, and analysts predict further growth as new chipmaking facilities open in the U.S. by 2027, including those by Intel, Samsung, and TSMC.

Why It's Important?

The Nvidia-Intel deal marks a significant development in the semiconductor industry, potentially revitalizing Intel's market position and boosting ASML's growth prospects. As Intel strengthens its capabilities in AI and data centers, it could regain competitiveness, benefiting the broader U.S. tech sector. ASML's anticipated growth underscores the increasing demand for advanced semiconductor equipment, crucial for expanding domestic chip production. This development aligns with U.S. efforts to enhance its semiconductor manufacturing capabilities, reducing reliance on foreign suppliers and bolstering national security.

What's Next?

Investors are likely to focus on the expected revenue acceleration for ASML in 2027, driven by the opening of new U.S. chipmaking facilities. The semiconductor industry may see increased investments and collaborations, as companies aim to capitalize on the growing demand for AI and data center technologies. Stakeholders, including tech companies and policymakers, will monitor the impact of this deal on the U.S. semiconductor landscape and its implications for global competitiveness.