What is the story about?

What's Happening?

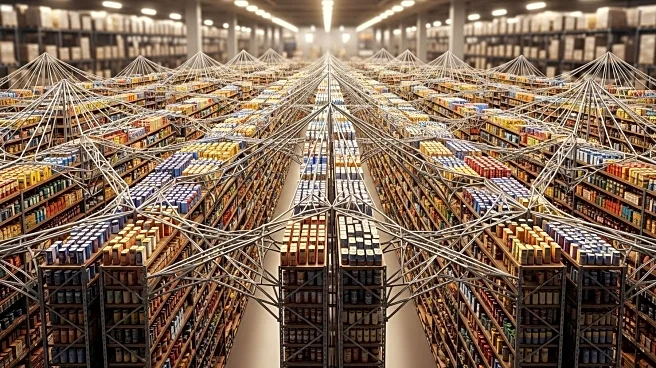

C&S Wholesale Grocers LLC has finalized its acquisition of SpartanNash Co., a fellow grocery distributor, in a deal valued at $1.77 billion. This strategic move, announced in June, significantly expands C&S's operational footprint, adding SpartanNash's annual net sales of nearly $10 billion to C&S's existing sales, bringing the total to approximately $30 billion. The acquisition increases C&S's workforce to over 30,000 employees and enhances its distribution capabilities with nearly 60 centers nationwide, serving around 10,000 independent grocery retail locations and operating more than 200 supermarkets. The merger aims to create a more efficient supply chain, offering lower costs of goods to help retail customers compete in the $1 trillion US food-at-home market.

Why It's Important?

The acquisition of SpartanNash by C&S Wholesale Grocers is a significant development in the grocery distribution industry, as it consolidates two major players to enhance competitive capabilities against large grocery retailers. This merger is expected to redefine industry standards by providing advanced solutions and improving supply chain efficiency, which could lead to cost savings for consumers. The deal also marks a shift in SpartanNash's business model from public to private, potentially impacting its operational strategies and market approach. The expanded distribution network and increased scale could lead to more robust market presence and influence in the grocery sector.

What's Next?

Following the acquisition, Tony Sarsam, the president and CEO of SpartanNash, will serve as an adviser during the transition period. The combined company plans to leverage its enhanced capabilities to create new opportunities for employees, customers, and shoppers. The focus will be on delivering innovative food solutions and driving future growth. Additionally, C&S's recent settlement with Kroger regarding a termination fee for a previous divestiture deal may influence future strategic decisions and partnerships within the industry.

Beyond the Headlines

The acquisition highlights the ongoing trend of consolidation in the grocery distribution sector, driven by the need for increased scale and efficiency. This trend may lead to further mergers and acquisitions as companies seek to enhance their competitive edge. The shift of SpartanNash from public to private could also influence its corporate governance and strategic priorities, potentially affecting its long-term growth trajectory.