What is the story about?

What's Happening?

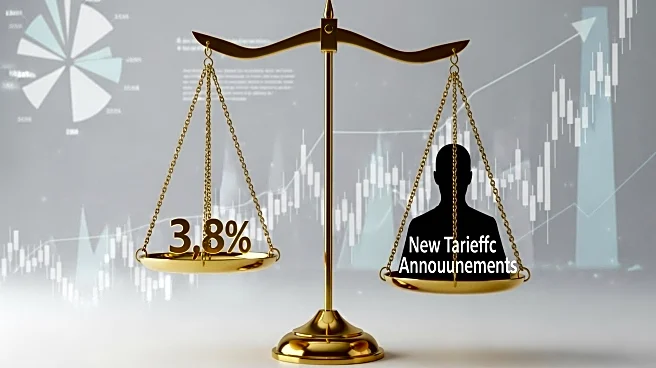

The US economy experienced a significant expansion in the second quarter, growing at an annualized rate of 3.8%, up from the initial estimate of 3.3%. This growth, the fastest in nearly two years, was largely driven by increased consumer spending. The revised economic data was released ahead of the Federal Reserve's preferred inflation gauge and the upcoming nonfarm payrolls report. Concurrently, President Trump announced new tariffs targeting pharmaceuticals, big trucks, and furniture, which added to market uncertainty. These developments led to a retreat in Asian markets and a decline in major US stock indexes, which had been reaching record highs earlier in the week.

Why It's Important?

The robust economic growth highlights the resilience of the US economy despite ongoing trade tensions and interest rate uncertainties. The new tariffs announced by President Trump could have significant implications for various industries, particularly pharmaceuticals and manufacturing, potentially leading to increased costs for consumers and businesses. The market's reaction to these developments underscores the sensitivity of global financial markets to US economic policies and data. The growth figures also play a crucial role in shaping the Federal Reserve's monetary policy decisions, as they balance between fostering economic growth and controlling inflation.

What's Next?

The upcoming release of the Federal Reserve's preferred inflation measure and the nonfarm payrolls report will provide further insights into the economic outlook and may influence future interest rate decisions. Additionally, the impact of the new tariffs on the affected industries and consumer prices will be closely monitored. Market participants will also be watching for any further policy announcements from the Trump administration that could affect economic conditions.