What is the story about?

What's Happening?

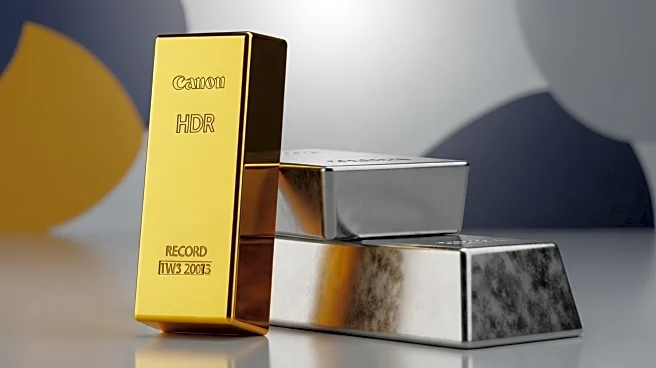

Gold and silver prices have reached record highs, with gold surpassing $4,000 per ounce and silver exceeding $50 per ounce. This surge is driven by a combination of factors including geopolitical tensions, U.S. political turmoil, and expectations of Federal Reserve rate cuts. Investors are flocking to these precious metals as safe-haven assets amidst ongoing conflicts in the Middle East and Ukraine, high global debt, and inflation concerns. Central banks are also contributing to the rally by purchasing significant amounts of gold, reinforcing the upward trend. Silver's rise is further fueled by strong industrial demand and supply shortages, marking the fifth consecutive year of a global silver deficit.

Why It's Important?

The record-breaking prices of gold and silver have significant implications for various stakeholders. Investors seeking stability amidst economic and political uncertainty are turning to these metals, which traditionally serve as hedges against turmoil. The surge in prices reflects broader concerns about currency debasement and inflation, prompting a shift towards tangible assets. The rally has also impacted financial markets, with precious metals ETFs and mining stocks experiencing substantial inflows. However, the high prices may pose challenges for industries reliant on silver for technological and industrial applications, potentially leading to increased costs and supply chain disruptions.

What's Next?

Analysts predict continued volatility in the precious metals market, with potential short-term pullbacks as geopolitical tensions fluctuate. Despite recent profit-taking, the consensus is that the bull market for gold and silver remains strong, supported by ongoing demand and supply constraints. Major banks have raised their price targets, anticipating further increases in the coming months. Investors are advised to monitor developments closely, as any changes in Federal Reserve policy or geopolitical events could influence market dynamics. The long-term outlook remains bullish, with expectations of new price floors for gold and silver.

Beyond the Headlines

The rally in gold and silver prices highlights deeper economic and geopolitical shifts. As confidence in fiat currencies erodes, the demand for tangible assets like precious metals is likely to persist. This trend underscores the importance of diversifying investment portfolios to mitigate risks associated with currency fluctuations and inflation. Additionally, the industrial demand for silver, driven by advancements in technology and renewable energy, emphasizes the need for sustainable resource management to address supply shortages. The ongoing geopolitical tensions and economic uncertainties may continue to drive investors towards safe-haven assets, shaping market trends in the foreseeable future.