What's Happening?

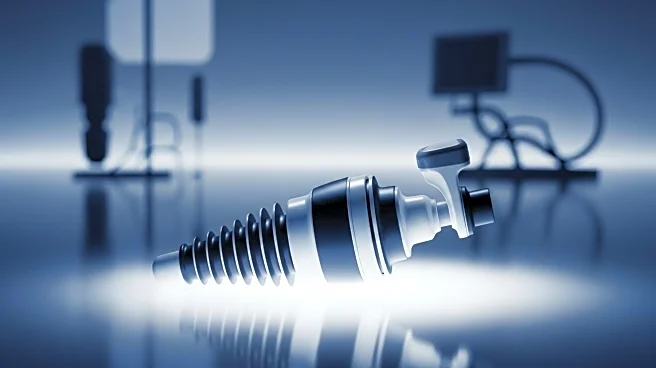

Johnson & Johnson announced plans to spin off its orthopaedics business, DePuy Synthes, into a standalone company. The announcement coincided with the company's third-quarter earnings report, which exceeded expectations with adjusted earnings of $2.80 per share and nearly $24 billion in sales. The spin-off aims to focus J&J's operations on higher-growth areas such as oncology, immunology, and cardiovascular. The separation is expected to be completed within 18 to 24 months, with DePuy Synthes becoming the largest orthopaedics-focused company in the industry.

Why It's Important?

The spin-off of DePuy Synthes is a strategic move by Johnson & Johnson to concentrate on high-growth healthcare segments, potentially improving margins and operational efficiency. This decision reflects a broader industry trend of companies restructuring to enhance focus and drive growth. The announcement has implications for J&J's stock performance, as investors assess the potential benefits and risks associated with the separation. The company's strong third-quarter earnings and raised sales outlook further underscore its commitment to growth and innovation.

What's Next?

Johnson & Johnson will proceed with the spin-off process, exploring various paths to achieve the separation. The company aims to complete the transaction within 18 to 24 months, with DePuy Synthes poised to lead the orthopaedics market. Investors will be monitoring the progress of the spin-off and its impact on J&J's financial performance and market position. The company's focus on high-growth areas is expected to drive future revenue and earnings growth, with potential implications for its stock valuation.